Fuel Prices Rise – But Will It Continue?

Markets continued their upward trajectory today, gaining over 1%, as a combination of geopolitical developments, supply and demand dynamics, and economic expectations drove sentiment. One of the main factors influencing prices is OPEC+’s decision to gradually increase production starting in April. However, speculation remains that the group may delay these increases until June, aligning with the peak summer travel season when fuel demand is highest.

Geopolitical tensions have also added pressure to prices. Comments from President Donald Trump about the possibility of reducing Iran’s oil exports to zero have drawn attention, as such a policy could result in a supply shock, further tightening the global market. Additionally, conflicts in the Middle East continue to be a concern. Trump’s commitment to continued U.S. strikes against Yemen’s Houthis, coupled with his warning that Iran would be held responsible for any Houthi-led attacks in the Red Sea, has raised fears of potential supply disruptions. Meanwhile, escalating violence in Gaza, where Israeli airstrikes killed at least 200 people, has added another layer of uncertainty. While ongoing geopolitical risks in Russia and Ukraine remain under scrutiny, they have not significantly disrupted supply so far.

Economic expectations, particularly in China, have also bolstered prices. Reports of potential stimulus measures in China suggest that the world’s second-largest economy could see increased growth, which would, in turn, drive higher energy demand. The Chinese government recently unveiled a plan to boost domestic consumption through measures such as increasing incomes and offering childcare subsidies. Stronger-than-expected retail sales and fixed asset investment growth, along with a 2.1% rise in crude oil throughput in January and February, indicate strengthening demand in the world’s largest crude importer.

Despite these bullish factors, bearish sentiment persists. The OECD has warned that Trump’s proposed tariffs could slow economic growth in the U.S., Canada, and Mexico, potentially weighing on global energy demand. Furthermore, Venezuela’s state-run PDVSA is preparing to continue oil production and exports. Increased Venezuelan output could contribute to rising global supply, putting downward pressure on prices. Peace talks between Trump and Russian President Vladimir Putin, scheduled for Tuesday, could result in the easing of sanctions on Russia, allowing more crude to flow into global markets.

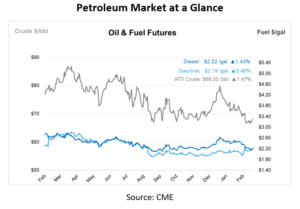

Goldman Sachs has lowered its crude oil price forecasts for 2025 and 2026, citing weaker demand growth and a bearish supply outlook. The bank now expects Brent to average $71/bbl in 2025 and $68 in 2026, while WTI is projected at $67 and $64/bbl, respectively. Goldman no longer sees $70 Brent as a firm floor but expects a modest increase by June, with Brent and WTI reaching $74 and $70/bbl, respectively. The bank also sees potential economic relief from Federal Reserve policies and limited tariff damage.

Weaker U.S. GDP growth and tariffs are expected to slow global oil demand, with a 900,000 bpd increase in 2025—200,000 bpd lower than prior estimates. The bank warns of additional downside risks from potential Trump administration negotiations with Russia and Iran.

This article is part of Daily Market News & Insights

Tagged: bullish factors, fuel prices, tarriffs, U.S.

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.