New Tariffs on Canadian Imports: What It Means for DEF Prices?

New trade measures between the U.S. and Canada have introduced tariffs that could impact key industries. The latest round of tariffs has raised concerns about increased costs across various sectors, including Diesel Exhaust Fluid (DEF), which is essential for emissions control in diesel engines. These measures could ripple through supply chains, affecting pricing and availability for businesses that rely on cross-border trade.

The US government announced on March 4, 2025, it imposed a 25% tariff on goods imported from Canada, with a reduced 10% tariff on energy products. In response, Canada imposed a 25% tariff on $30 billion worth of US goods.

Impact on DEF Pricing

Concerns have been raised regarding how these tariffs will influence the price of Diesel Exhaust Fluid (DEF). While Canada is a key exporter of urea—a primary component of DEF—the overall effect on DEF pricing is expected to be limited.

According to Andy Austin, SVP of Special Products at Mansfield, the impact of tariffs on DEF pricing is a common concern. He noted that Canadian imports account for under 5% of the total U.S. DEF supply. Even with a 25% tariff, this would equate to only a 1.25% increase for overall U.S. DEF supply prices, assuming all other factors remain unchanged. There are some U.S. geographies whose DEF prices may be more impacted by a tariff on Canadian urea imports, particularly the northeastern U.S. which receives a disproportionate of its DEF supply from Canada.

Regarding Mansfield’s DEF supply specifically, the impact of Canadian urea tariffs on DEF prices is expected to be de minimis. Mansfield sources DEF in the same country in which it is delivered, limiting cross-border trade. Less than 0.5% of Mansfield’s total U.S. DEF demand—is imported from Canada. Given this limited volume, the direct effect of tariffs on Mansfield’s overall U.S. DEF pricing is expected to be limited.

- Did you know that the DEF market is growing fast? Learn here why DEF demand is set to increase and how to plan ahead.

Broader Implications for the Fertilizer Market

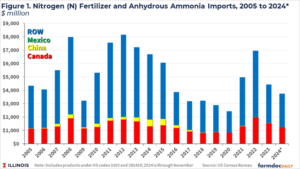

While DEF pricing is unlikely to see a substantial increase, the tariffs could have a more pronounced effect on the nitrogen fertilizer market. The US is a major importer of nitrogen-based fertilizers, and Canada is a significant supplier. According to the Farm Doc Daily, since 2020, the U.S. has imported over $4.5 billion worth of anhydrous ammonia and other nitrogen fertilizers, with Canada accounting for more than 30% of these imports—an average of $1.4 billion annually.

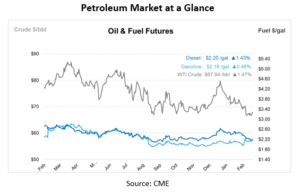

According to the Energy Information Administration (EIA), tariffs will raise the cost of imported nitrogen fertilizers, potentially increasing costs for US farmers and other agricultural stakeholders. Tariffs on imported Canadian natural gas – a key input of nitrogen fertilizer production—may impact domestic urea and DEF pricing, but Mansfield expects this to have a limited impact on domestically produced urea and DEF. The US has been a net exporter of natural gas since 2017 and in n 2024, the US produced about 38 trillion cubic feet of natural gas while importing less than 3 trillion cubic feet from Canada.

This article is part of DEF

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.