Natural Gas News – March 14, 2025

Natural Gas News – March 14, 2025

Hedge Funds Turn Bearish on Oil, Bullish on Natural Gas

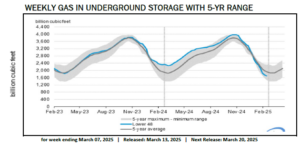

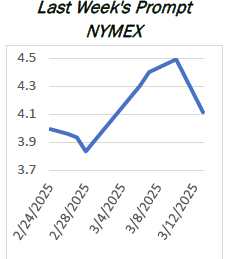

Traders haven’t been this bearish on oil in months or so bullish on U.S. natural gas in years. The latest data on money managers’ positioning in the WTI and Brent crude and U.S. natural gas futures showed two contrasting trends—speculators are betting that oil prices would remain low or go even lower while increasing the bets that natural gas prices would continue marching higher. So far this year, geopolitical and supply and demand factors have been increasingly bearish for the oil price outlook and increasingly bullish for natural gas prices. In the oil market, hedge funds and other portfolio managers have been slashing their bullish bets since the end of January, when the U.S. sanctions on Russia’s oil trade were the primary bullish driver of managed money to bet on a tightening market.… https://tinyurl.com/yfeanxjx

Demand Uncertainty and Supply Risks Drive Market Instability

Oil prices rebounded after a sharp decline, as uncertainty over energy supply disruptions continued to weigh on market sentiment. Geopolitical tensions have dimmed prospects for increased Russian energy exports, sustaining volatility in crude markets. Meanwhile, escalating global trade disputes threaten demand, with the International Energy Agency revising down its oil consumption forecasts for late 2024 and early 2025. While supply growth remains strong, energy traders remain cautious as ongoing instability could trigger renewed price spikes. Analysts warn that while short-term projections lean bearish, disruptions from geopolitical events may keep markets volatile, reinforcing energy’s role as a key risk hedge.… For more info go to https://tinyurl.com/y7j33fch

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.