U.S. Tariffs Trigger Global Response as OPEC+ Adjusts Output

On March 3, 2025, President Trump announced that tariffs on imports from Canada, Mexico, and China would move forward as scheduled, taking effect on March 4. The new tariffs include an additional 10 percentage point (pp) tariff on Chinese imports, raising the effective tariff rate by 1.2pp and leading to a forecasted 0.1% increase in core prices. Imports from Canada and Mexico will face a 25% tariff, with Canadian energy products subject to a lower 10% rate. These tariffs could raise the overall effective tariff rate by 5.7pp and increase core prices by approximately 0.6%. While the administration previously delayed similar measures in February, some uncertainty remains as analysts speculate the tariffs could be postponed again until April 2, when the administration plans to announce a broader set of trade policies.

The economic impact of these tariffs is expected to vary across sectors. Some domestic industries may benefit from reduced foreign competition, but others could face higher production costs due to the rising prices of imported materials. Additionally, US exports may be targeted by retaliatory tariffs, further disrupting industries reliant on international trade. Alongside the newly announced tariffs, the White House has already implemented tariffs on steel, aluminum, and Chinese imports, with plans to extend tariffs to critical imports and automobiles from the European Union.

In the energy sector, OPEC+ has announced plans to gradually restore oil production, beginning with a 138,000 bpd increase in April, part of a broader plan to return 2.2 Mbpd to the market by 2026. OPEC+ emphasized that these increases could be paused or reversed depending on market conditions, maintaining flexibility to support market stability. In February, OPEC+ production rose by 240,000 bpd, bringing total output to 27.35 Mbpd, with Iraq, the UAE, and Venezuela accounting for most of the increase.

Following the US tariff announcement, Canada’s Foreign Minister Melanie Joly confirmed that Canada will proceed with retaliatory tariffs first announced in early 2025. The first wave will cover C$30 billion worth of US goods, while the second wave will target C$125 billion in cars, trucks, and aluminum. These actions, combined with ongoing trade tensions, are expected to further disrupt global trade flows and increase market uncertainty.

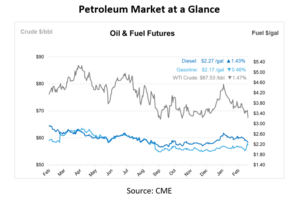

Despite OPEC+ citing healthy market fundamentals, others have questioned the outlook, noting that Asian crude imports declined in the first two months of 2025, seaborne arrivals to Europe and the Middle East weakened, and investor sentiment deteriorated as there is a reduced number of net long positions in crude futures. Coupled with slowing demand from China’s refinery maintenance season and growing uncertainty surrounding global tariffs and sanctions, these factors make up a bearish outlook for oil prices.

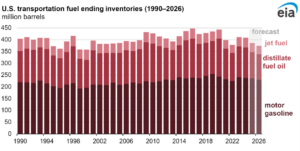

At the same time, the US Energy Information Administration (EIA) forecasts that US inventories of motor gasoline, distillate fuel oil, and jet fuel will fall to their lowest levels since 2000 by the end of 2026, thanks to refinery closures and rising demand. With two refineries set to close, domestic refined product output will shrink, and combined with rising demand, inventories are expected to end 2026 at approximately 375 million barrels. Historically, declining inventories increase wholesale and retail fuel prices, though falling crude oil prices may soften the impact.

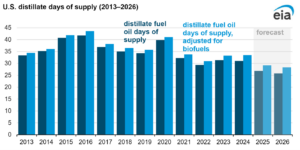

While gasoline demand is expected to decline slightly due to more fuel-efficient vehicles and slower employment growth, distillate fuel inventories are expected to remain relatively low, even as biodiesel and renewable diesel account for 9% of total distillate consumption. Jet fuel inventories are forecast to be particularly tight, with consumption hitting record highs and inventories falling to just 21 days of supply, the lowest since 1963.

This article is part of Daily Market News & Insights

Tagged: 2025, Global Response, opec, U.S. Tariffs

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.