Week in Review: Rising Inventories, Weakened Demand, and Cold Weather Shake Prices

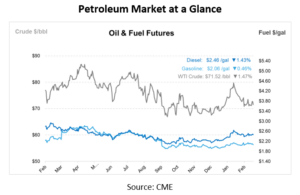

Oil prices fell on Friday just shy of $1/bbl but remained on track for a weekly gain due to supply disruptions in Russia and uncertainty surrounding a potential Ukraine peace deal. Brent crude dropped to $75.58 per barrel, while WTI declined to $71.52 per barrel.

Geopolitical tensions escalated as relations between Ukraine’s President Zelenskiy and President Trump worsened over peace negotiations. Trump criticized Zelenskiy, who in turn accused Trump of being influenced by Russian disinformation. Despite the rift, Ukraine expressed readiness to negotiate a security and investment agreement with the U.S.

Builds in U.S. crude stockpiles began pressuring the market on Thursday. The American Petroleum Institute reported a 3.34 million-barrel increase in U.S. crude inventories, ahead of official EIA data, which showed a 4.6 million barrel increase in inventories. Market uncertainty persists, with supply disruptions in Kazakhstan and OPEC+ production delays balanced by global demand concerns. A Ukraine drone attack reduced Caspian Pipeline Consortium flows by 30%-40%, removing up to 380,000 bpd from the market. However, a potential resumption of Iraqi Kurdistan oil exports could add 300,000 bpd, offsetting some supply risks.

Frigid temperatures across the U.S. Northeast have driven an uptick in heating oil demand since the start of the year, counteracting a long-term decline caused by reduced industrial activity and renewable alternatives. U.S. distillate fuel inventories—including diesel and heating oil—dropped to their lowest seasonal level since 2014, with demand for distillates averaging 3.9 Mbpd, 9% higher than last year and 6.5% above the five-year average. Colder-than-average January temperatures set off an estimated 100,000 bpd increase in heating oil demand in both December and January, boosting East Coast diesel refining margins to an 11-month high. Meanwhile, U.S. diesel exports rose by nearly 20% in January, further pressuring domestic supply.

Despite the recent weather-driven spike, long-term distillate consumption is declining due to sluggish industrial activity. U.S. manufacturing has contracted for two years, reducing diesel demand from key energy-consuming sectors like construction, steel, and transportation. The trucking industry hit its lowest point since January 2024, reflecting weaker economic growth. While the EIA projects diesel consumption growth, future trends remain uncertain as potential new tariffs on China and steel imports could further strain U.S. manufacturing. Renewable diesel consumption is also rising, particularly in California, Oregon, and Washington, with usage growing from 50,000 bpd in 2020 to 240,000 bpd in 2024.

Prices in Review

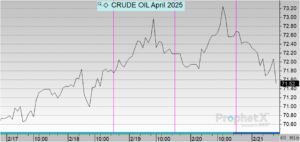

Crude opened the week on Tuesday at $70.70 and say steady increases throughout the week. This morning, crude opened at $72.58, an overall increase of $1.88 or 2.66%.

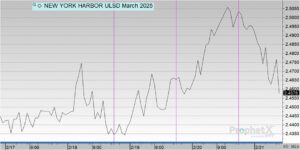

Diesel opened the week at $2.4501, traded down slightly on Wednesday, and then saw some increases on Thursday. This morning, diesel opened at $2.4999, an overall increase of nearly 5 cents or 2.03%.

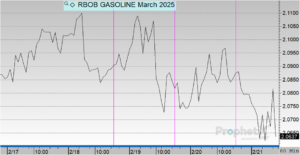

Gasoline opened the week at $2.0833, increased once cent on Wednesday and then dropped a cent on Thursday. This morning, gasoline opened at $2.0899, an overall increase of less than one cent or 0.32%.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.