Oil Prices React to Supply Cuts, OPEC+ Uncertainty, and Ukraine Conflict

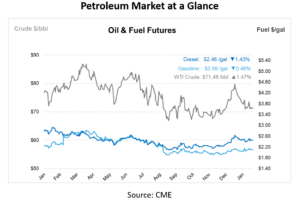

Oil markets are responding to new supply disruptions and geopolitical developments. Brent crude, which briefly rose above $76 earlier in the session, has retreated as traders weigh geopolitical risks and potential supply adjustments. WTI increased by 51 cents from Friday’s close to $71.25 per barrel, marking its first movement since US markets closed on February 14 for the Presidents’ Day holiday.

Over the weekend, Ukrainian drone attacks on Russian oil infrastructure disrupted crude exports through Kazakhstan, raising concerns over global supply. Meanwhile, US and Russian officials began talks in Saudi Arabia regarding the war in Ukraine, a development that could significantly impact global energy markets.

On February 17, Ukrainian drones struck a Russian oil pumping station on the Caspian Pipeline Consortium (CPC) route, which transports Kazakh crude through Russia. Russian oil transport company Transneft stated that the damage could reduce Kazakhstan’s oil transit volumes by 30% for up to two months. With Kazakhstan accounting for about 1% of global crude supply, the disruption is significant. However, broader economic factors have tempered the market’s reaction, with traders waiting for further developments.

OPEC+ is set to review its production strategy ahead of an expected April 2025 increase of 120,000 barrels per day. While some members have indicated the possibility of delaying the increase due to market conditions, Russian Deputy Prime Minister Alexander Novak has stated that the current schedule remains unchanged. If OPEC+ does move forward with an additional delay, it would mark the fourth postponement of production increases since 2022. The group has maintained a cautious approach in response to uncertain global demand and geopolitical risks, balancing the need to stabilize prices while ensuring competitiveness in the global market.

While OPEC+ aims to manage supply to support prices, external pressures are growing. The US continues to push for lower energy costs, particularly as inflation remains a concern, while competition from non-OPEC producers such as Brazil, Guyana, and the US itself adds complexity to the group’s long-term strategy. The market is closely watching OPEC+ deliberations, as any adjustment to production plans could shift price expectations in the coming months.

This morning, US and Russian officials met in Riyadh, Saudi Arabia, to discuss a potential resolution to the war in Ukraine. The talks, however, did not include Ukrainian representatives, and Russia introduced a new demand that NATO revoke its 2008 commitment to Ukraine’s potential membership. The meeting’s outcome could influence Western sanctions on Russian oil, which would directly impact global energy flows. A relaxation of sanctions could lead to increased supply, weighing on prices, while continued restrictions would maintain current supply constraints.

The European diesel market is also showing signs of tightness, with futures trading in backwardation. Supply constraints have been exacerbated by refinery outages and reduced imports from the US. A decline in diesel shipments into the European Union and UK in January 2025 has added to concerns over availability, particularly as colder temperatures drive up heating oil demand.

Oil analysts predict that Brent crude will average $74 per barrel in 2025, with a potential decline to $66 per barrel in 2026 as supply growth outpaces demand. However, short-term price movements will be dictated by developments in US-Russia peace talks, OPEC+ production decisions, and the extent of ongoing supply disruptions in Kazakhstan.

This article is part of Daily Market News & Insights

Tagged: oil prices, OPEC+ Uncertainty, Supply Cuts, Ukraine Conflict

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.