Natural Gas News – February 17, 2025

Natural Gas News – February 17, 2025

Mansfield Market Assessment

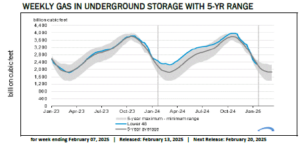

Weather forecasts show we are getting another wave of really cold weather starting today and extending thru Friday. After that, we return to the 10-year normal for several days with weather warming up nationwide. The market appears currently off $0.16 cents as a result of the cold weather. Its really going to be important to see if we can hold the warm pattern going forward. We believe the damage to end of season storage has been done and we recommend buying any dips especially for Q2. At this point a 10-year normal March is bullish and if we get a week of cold in Q2 we could potentially see gas at $4.00.

Market Faces Volatility: Prices Slip After Five-Day Rally

Natural gas futures slipped nearly 3% on Monday as traders took profits following a shift in weekend weather forecasts. Despite last week’s bullish momentum, the market remains prone to selling into rallies, keeping gains in check. The recent pullback comes after a strong five-day winning streak, where prices surged 12.57% to settle at $3.725 on Friday. Colder forecasts, tightening storage, and robust LNG demand had fueled the rally, but traders are now reassessing near-term risks. The immediate resistance now sits at $3.801, with a breakout above this level potentially opening the door for a move toward January’s peak at $4.020… For more info go to https://tinyurl.com/4uhbevwb

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.