EIA Report: Supply and Demand Trends Mirror Last Year’s Numbers

The latest report from the U.S. Energy Information Administration (EIA) paints a picture of a petroleum market that’s tracking closely with the same week of 2024. But what do the numbers actually tell us? Let’s break it down.

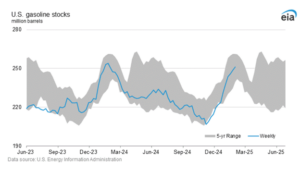

Gasoline Inventories Continue to Build

One of the key takeaways from last week’s report is the continued rise in gasoline inventories. Stocks increased by 2.2 million barrels (bbl), marking the 12th consecutive weekly build. This pushed total gasoline inventories above 250 million bbl for the first time in nearly a year, bringing them in line with last year’s levels.

What’s behind this? A mix of wintry weather and seasonal gasoline blending shifts. Demand held steady as cold temperatures kept people on the roads, while perishable winter-grade gasoline likely played a role in the buildup. The biggest inventory gains were seen on the East Coast (PADD 1) and the Midwest (PADD 2), with stocks rising by 3.4 million bbl and 1 million bbl, respectively.

Meanwhile, gasoline production remained robust, coming in at 9.174 million barrels per day (b/d) for the second straight week. That’s a slight increase compared to the same period last year, but demand numbers tell a different story.

Gasoline Demand Still Lags Behind Previous Years

While gasoline demand edged higher last week to 8.328 million b/d, it still trailed the comparable weeks of 2023 and 2024. However, when factoring in ethanol blending, total motor fuel demand may be slightly higher than it appears. The EIA estimated that 860,000 b/d of ethanol was blended with gasoline last week, which suggests a 10% blend rate and an implied gasoline demand of 8.6 million b/d.

The four-week average for gasoline demand was just a few barrels shy of last year’s level, suggesting stability in overall consumption patterns. But with the transition to summer fuel blends approaching, will refiners start discounting winter-grade gasoline to clear inventories? Spot and wholesale markets may see some price shifts in the coming weeks.

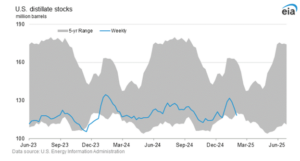

Distillate Stocks Take a Hit

On the distillate side, inventories dropped sharply by 5.5 million bbl, extending a three-week drawdown that has totaled 13.5 million bbl. This latest decline brought distillate stocks more than 7 million bbl below the year-ago level.

Cold weather likely played a significant role, as heating demand tends to spike in the winter months. EIA data showed that PADD 1 experienced the largest draw at 2.4 million bbl, with the Mid-Atlantic region accounting for 1.9 million bbl of that total.

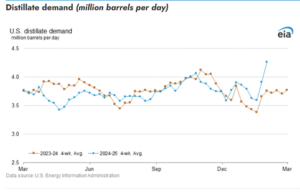

Distillate production also dipped last week, falling by 186,000 b/d to 4.552 million b/d. Meanwhile, demand rose by 93,000 b/d to 4.599 million b/d, keeping year-to-date figures 13% higher than the same period in 2024.

One notable shift was in distillate exports, which fell below 1 million b/d for the first time since March, coming in at 893,000 b/d.

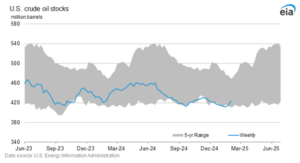

Crude Oil Stocks Post a Surprise Build

The EIA’s report also showed an unexpected 8.7-million-bbl build in crude oil stocks. This came despite an increase in crude exports, which rose by 645,000 b/d to 4.331 million b/d. Imports also increased, climbing by 467,000 b/d to 6.915 million b/d, with Canadian crude entering the U.S. at a rate of 4.063 million b/d.

Meanwhile, refiners on the Gulf Coast (PADD 3) seem to be recovering from the late-January cold snap. Refinery runs in the region rose by 200,000 b/d to 8.103 million b/d, helping to boost nationwide crude runs to 15.511 million b/d. The national utilization rate also ticked up to 81.1%, an improvement from the previous week.

What’s Next?

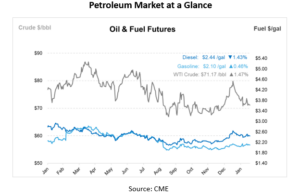

With gasoline stocks climbing, distillate inventories tightening, and crude oil holding steady, the market appears balanced—at least for now. But seasonal shifts are on the horizon. Will gasoline demand pick up as temperatures rise? Will distillate stocks continue to shrink, pushing prices higher? The next few weeks will provide good insights into how supply and demand will shape fuel markets heading into spring.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.