Natural Gas News – February 14, 2025

Natural Gas News – February 14, 2025

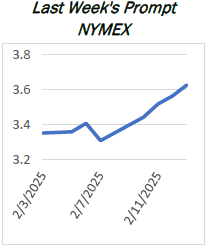

EIA Natural Gas Storage Draw Of -100 Bcf Exceeds Estimates

On February 13, 2025, EIA released its Weekly Natural Gas Storage Report. The report indicated that working gas in storage decreased by -100 Bcf from the previous week, compared to analyst forecast of -92 Bcf. In the previous week, working gas in storage declined by -174 Bcf. At current levels, stocks are -248 Bcf less than last year and -67 Bcf below the five-year average for this time of the year. Natural gas prices moved higher as traders reacted to the EIA report. The storage draw exceeded analyst estimates, which is bullish for natural gas markets. Weather forecasts are favorable for the bulls. Current demand for natural gas is high, and forecasts indicate that it will stay at high levels in the upcoming days.… https://tinyurl.com/nfe7fjkz

Natural gas prices climb; winter conditions to stay

US natural gas prices soared Thursday, boosted by continued chilly conditions as well as opposition to reported plans by the European Union to cap prices. At 08:40 ET (13:40 GMT), natural gas prices rose 4.1% to $3.710 per million British thermal units, or MMBtu, over 8% higher over the course of the last week. Gas prices had fallen to a degree during the previous session following a report in the Financial Times which suggested the European Union was considering new powers to temporarily cap EU gas prices, which have recently hit record levels compared with the US. The European Commission is preparing a package of measures, due to be proposed on February 26, to improve industries’ competitive edge and help bring down energy prices.… For more info go to https://tinyurl.com/2vxtwzcs

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.