Oil Prices Remain Volatile Thanks to Trade & Supply Uncertainty

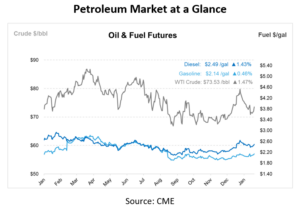

Fuel prices across North America have increased recently, driven by a complex mix of trade policies under the new Trump administration, supply issues, and global geopolitical events. On Monday, Brent crude oil prices rose by 1.2% to $75.53 per barrel, while WTI increased by 1.3% to $71.90. This uptick followed three straight weeks of price declines caused by trade-related uncertainty. Today, WTI is up over $1.20/bbl to $73/bbl after Trump announced 25% tariffs on steel and aluminum imports yesterday. Market analysts point out that President Donald Trump’s history of modifying or temporarily suspending tariffs, as seen with Canada and Mexico last week, may help prevent prolonged volatility.

Despite these reassurances, the trade war rhetoric continues to escalate. The U.S. has imposed 25% tariffs on steel and aluminum imports, which impacts key trading partners like Canada and Mexico. China retaliated with tariffs on U.S. goods, including a 10% duty on American crude oil imports. An all-out trade war could slow global economic growth, reducing energy demand and potentially keeping prices elevated in the short term.

Geopolitical factors are also pushing prices higher. U.S. sanctions on Russian oil shipments to major importers like China and India have disrupted global supply chains, and renewed sanctions on Iranian oil exports are creating further supply pressures. Hamas has reportedly postponed the release of Israeli hostages, citing alleged violations of a ceasefire agreement by Israel. The release, originally set for February 15, has been delayed indefinitely. In response, President Trump warned that severe consequences would follow if Hamas did not release all hostages by the weekend, stating that “all hell” would break out.

Citigroup recently revised its oil price projections for 2025, expecting Brent crude to average $75 per barrel in the first quarter before declining to around $60 per barrel by the year’s end. The bank attributes the potential for lower prices to an anticipated 800,000 bpd global supply surplus. However, this surplus could be diminished by ongoing sanctions and trade disputes. Citi maintains a bearish outlook, assigning a 60% probability to this base scenario but noting both bullish and bearish possibilities. In a bullish case, prices could hit $90 per barrel if tensions escalate further. Conversely, Brent could fall to the mid-$40s by year’s end under more favorable supply conditions.

Refinery operations are also facing hurdles due to the declining quality of crude imports from Mexico. U.S. refiners along the Gulf Coast have reported receiving shipments with water content as high as 6%, far above acceptable levels. This issue has forced many refineries in Texas and Louisiana to seek alternative supplies from Colombia and Canada, driving up costs and complicating fuel production.

These challenges mean that the path to lower prices may not be straightforward. On one hand, trade and geopolitical tensions could keep prices elevated. On the other hand, the anticipated increase in global oil supply and potential policy shifts may bring relief in the coming years. Analysts also expect that President Trump’s desire for lower energy prices will continue to influence market dynamics, with a focus on balancing tariffs and sanctions against the need for affordable fuel.

This article is part of Daily Market News & Insights

Tagged: fuel prices, oil prices, Refinery operations, Trade & Supply, U.S.

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.