Week in Review: Cold Snaps, Colonial Shutdown, and Energy Policy Shifts

Fuel markets are navigating a mix of winter weather, supply chain disruptions, and shifting energy policies. While prompt crude futures opened slightly lower this morning, extending yesterday’s downward trend, they are set to end the week up by over $1.50/bbl, marking the fourth consecutive weekly gain. Gasoline and diesel futures are also set to end the week higher after sharp mid-week inclines.

A bitter cold snap blanketing much of the U.S., including typically mild southern states like Texas, has tightened distillate markets. Ultra-low sulfur diesel (ULSD) prices are experiencing upward pressure as the fuel doubles as a heating source in some regions. Meteorologists predict the bitter cold will last until late January, likely maintaining bullish momentum for distillates and pressuring heating oil crack spreads to climb further.

In the geopolitical landscape, tensions eased slightly after Bloomberg reported that Houthi militias signaled a pause in their maritime attacks following a ceasefire agreement between Israel and Hamas. While the Houthis warned of potential retaliation should the ceasefire fail, shipping routes saw some relief. However, the situation remains fragile, underscoring the ongoing volatility in the Middle East and its potential to disrupt global oil supply chains.

China reported a rare decline in refinery throughput, down 1.6% year-over-year in 2024, partly due to the increasing adoption of electric vehicles. The country still achieved its 5.4% GDP growth target, supported by strategic policy easing and robust export activity ahead of potential U.S. tariff hikes.

Domestically, the Colonial Pipeline’s Line 1 shut down on Tuesday due to a suspected gasoline release in Georgia. While the pipeline operator anticipates resuming operations today, some shippers have imposed supply allocations as a precaution. Although there are no immediate shortages, markets tied to spur lines, such as Memphis, TN, and Selma, NC, could face logistical challenges if the outage extends beyond today.

Meanwhile, the Biden administration proposed additional protections for over 3 million acres in Alaska’s National Petroleum Reserve, aiming to safeguard wildlife and limit drilling. While conservationists welcomed the move, the industry voiced concerns over increased regulatory hurdles for infrastructure projects in the region.

Canadian Energy Minister Jonathan Wilkinson addressed potential U.S. tariffs on Canadian goods, emphasizing the importance of a united response to safeguard cross-border trade. His comments follow escalating tensions around Alberta’s opposition to federal climate policies, highlighting the growing complexity of North American energy diplomacy.

Prices in Review

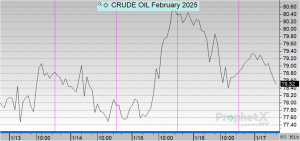

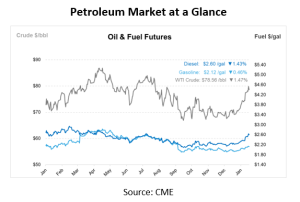

Crude opened the week at its lowest point for the week at $76.54. On Tuesday, crude saw a sharp $2 climb and another $2 jump on Thursday putting it back up above $80/bbl. This morning, crude opened at $78.75, an overall increase of $2.21 or 2.88%.

Diesel also opened the week at its lowest at $2.5027. It saw a three-cent bump on Tuesday, a one-cent bump on Wednesday, and then a nine-cent jump on Thursday. This morning, diesel opened at $2.6175, an overall increase of 11 cents or 4.58%.

Gasoline opened at $2.0736, its lowest for the week. It jumped three cents on Tuesday, one cent on Wednesday, and six cents on Thursday. This morning, gasoline opened at $2.1188, an overall increase of four cents or 2.18%.

This article is part of Daily Market News & Insights

Tagged: Week in Review

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.