Week in Review: Prices Push Higher on Winter Storm Demand and Wildfire Supply Risks

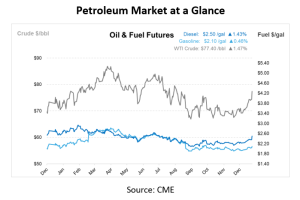

This week, petroleum futures saw sharp gains, driven by seasonal winter storm demand, looming supply risks from Southern California wildfires, and geopolitical concerns. The February WTI contract rose by $3/bbl this morning, the highest level in over three months. Cold weather across the U.S. and Europe spurred demand for heating oil, diesel, and kerosene. Anticipated U.S. sanctions on Russia’s oil industry further contributed to market bullishness, raising concerns over potential supply disruptions. In the Northeast, freezing temperatures increased the likelihood of fuel switching, with another cold wave forecasted for next week. On the West Coast, wildfires are spreading rapidly in the LA area, causing concerns over supply to linger in both inner and outer fuel markets.

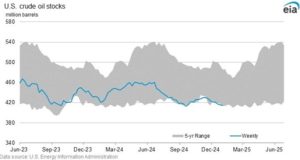

Inventory levels for crude, gasoline, and distillates remain below their five-year averages. Significant weekly builds of 6.3 million barrels for gasoline and 6.1 million barrels for distillates far exceeded market expectations. The EIA’s weekly inventory report revealed a crude draw of 0.96 million barrels, falling short of the API’s projected 3 million barrels.

On the global stage, China’s December inflation growth slowed to just 0.1%, raising fears of deflation, while shipping costs rose after the U.S. Military blacklisted China’s Cosco, its largest shipping company. Additionally, Saudi Arabia and Iraq announced February price hikes for crude destined for Asian, European, and U.S. markets. Canadian crude imports reached a record 4.42 Mbpd, accounting for 69% of total U.S. crude imports. Canada’s Energy Minister Jonathan Wilkinson warned of price increases and inflationary impacts should the U.S. impose tariffs on Canadian oil.

Stronger-than-expected U.S. job growth in December, with nonfarm payrolls rising by 256,000 and the unemployment rate dropping to 4.1%, signals a resilient labor market that supports consumer spending and economic growth. This strength reinforces the Federal Reserve’s cautious approach to interest rate cuts, suggesting that rates may remain higher for longer. For fuel prices, this could mean continued upward pressure as robust job growth and higher wages bolster consumer demand, particularly for transportation fuels. However, inflation concerns tied to labor market resilience could complicate rate policy, potentially influencing energy costs through macroeconomic adjustments.

Meanwhile, devastating wildfires in Southern California disrupted fuel pipeline and terminal operations, shutting down key systems due to power outages. Over 30,000 acres have been burned, with the Palisades Fire alone destroying thousands of structures and causing an estimated $10 billion in damages. Despite these disruptions, local refinery operations have remained unaffected, though logistical challenges persist.

Prices in Review

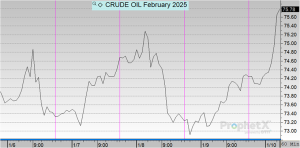

Crude futures opened on Monday at $74.05 before dropping back down on Tuesday. On Wednesday, crude increased back up to over Monday’s levels before decreasing on Thursday. This morning, crude has skyrocketed, opening at $74.29, up 24 cents or 0.32%, but on a continual rise.

Diesel opened on Monday at $2.3552 and has been on a steady incline since. This morning, diesel opened at $2.3911, an increase of 3 cents or 1.52%.

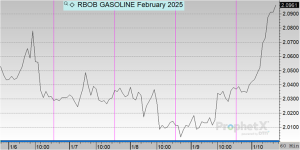

Gasoline opened on Monday at $2.0544 and tapered off a good bit throughout the week, unlike crude and diesel. This morning, gasoline opened at $2.0365, an overall decrease of almost 2 cents or -0.87%.

This article is part of Daily Market News & Insights

Tagged: Week in Review

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.