Week in Review – Oil Prices Kick Off the New Year with a Bullish Bang

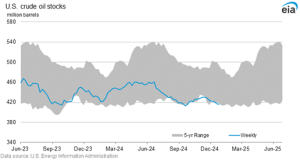

Crude oil prices started the new year on a bullish note, after reaching their highest levels in over two months. WTI is currently up over 20c/bbl to $73/bbl after hovering around the $70 mark since October. This uptick came on the heels of the Energy Information Administration (EIA) reporting a 1.2 million barrel draw—the sixth consecutive weekly draw. WTI’s prompt spread reached its highest level since October on Thursday. U.S. crude inventories are now about 5% below the five-year average for this time of year, reinforcing ongoing supply tightness.

The EIA also reported inventory data for the week ending December 27th, showing a gasoline build of 7.7 million barrels and a distillate build of 6.4 million barrels—both above expectations. Refinery utilization increased slightly by 0.20% to 92.7%, highlighting continued strong refining activity despite seasonal demand softness for gasoline. Distillate inventories remain 6% below the five-year average.

On the diesel front, days of supply has trended higher, reflecting increased inventory buffers since the COVID-19 demand rebound. However, the pending closure of the Lyondell refinery in Houston and prospects for stronger U.S. fuel demand in 2025 may add pressure to the market. Global diesel prices are expected to rely on refinery closures for price support going forward.

Looking at the crude market, low Strategic Petroleum Reserve (SPR) levels remain a point of interest. While current inventories are sufficient, a resurgence in demand could draw down supplies quickly, prompting renewed headlines about shortages. U.S. production may rise slightly, but longer-term concerns persist about whether U.S. output can keep pace with growing global demand, especially if OPEC+ spare capacity becomes a factor.

In policy developments, President Joe Biden is considering a decree to permanently ban new offshore oil and gas development in certain U.S. coastal waters. According to reports, the executive order could be issued within days and is expected to target areas critical to coastal resilience. The order leverages a 72-year-old law, which gives the White House authority to protect waters from future leasing. While specific regions were not disclosed, this move could have long-term implications for domestic energy production and investments.

Prices in Review

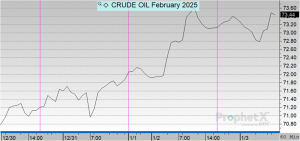

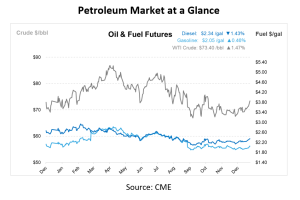

Crude oil opened the week at its lowest point for the week at $70.42. Crude saw gains throughout the week starting the year at it’s highest point in a few months. This morning, crude opened at $73.13, an overall increase of $2.71 or 3.85%.

Diesel opened the week at $2.2405 and also trended higher to start the year. This morning, diesel opened at $2.3575, accounting for an increase of 11 cents or 5.22%.

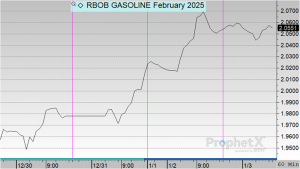

Gasoline opened the week at $1.9504 before trending higher for the rest of the week to start the new year. This morning, gasoline opened at $2.0533, an overall increase of 10 cents or 5.27%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.