Reuters Poll: Oil Prices Expected to Remain Near $70 in 2025

Oil prices are projected to remain constrained near $70 per barrel in 2025, according to a recent Reuters poll. Persistent weak demand, particularly from China, coupled with rising global supplies, is expected to counter OPEC+-led efforts to stabilize the market.

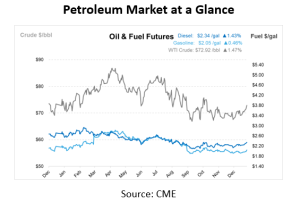

The survey, conducted among 31 economists and analysts, forecasts Brent crude to average $74.33 per barrel in 2025. This marks the eighth consecutive downward revision from the previous estimate of $74.53 in November. Brent crude has averaged approximately $80 per barrel in 2024, with a projected annual decline of around 3% driven by reduced demand from China, the world’s largest oil importer.

Projections for U.S. crude stand at an average price of $70.86 per barrel in 2025, slightly up from November’s estimate of $70.69. Analysts expect the oil market to face a surplus next year. JPMorgan predicts supply will outpace demand by approximately 1.2 million barrels per day (bpd). This surplus projection aligns with OPEC+’s decision in December to delay production increases until April 2025 and extend the unwinding of output cuts until the end of 2026.

“The decision was driven by the expectation that non-OPEC+ supply growth will outpace demand growth in 2025. This leaves limited room for OPEC+ to raise production,” said Florian Grunberger, senior analyst at Kpler. He added that further delays in unwinding production cuts might extend until the fourth quarter of 2025.

Global oil demand is expected to grow between 0.4 million and 1.3 million bpd in 2025, falling short of OPEC’s growth estimate of 1.45 million bpd.

Additionally, political factors could influence oil prices. While policy changes under a potential return of Donald Trump to the US presidency may not have a substantial long-term impact, analysts note that intensified sanctions on Iranian oil exports could provide short-term price support.

Despite ongoing adjustments from OPEC+ and potential geopolitical influences, ample supply and subdued demand are expected to keep oil prices near $70 per barrel through 2025.

This article is part of Daily Market News & Insights

Tagged: crude prices, Daily Market News & Insights, diesel, gas prices, gasoline, oil prices, U.S., wti crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.