Oil Prices Rise Amid Anticipated Cold Weather

FUELSNews will not be published tomorrow, January 1st, in observance of the New Year holiday. Regular publication will resume on Thursday, January 2nd. Mansfield wishes you a Happy 2025!

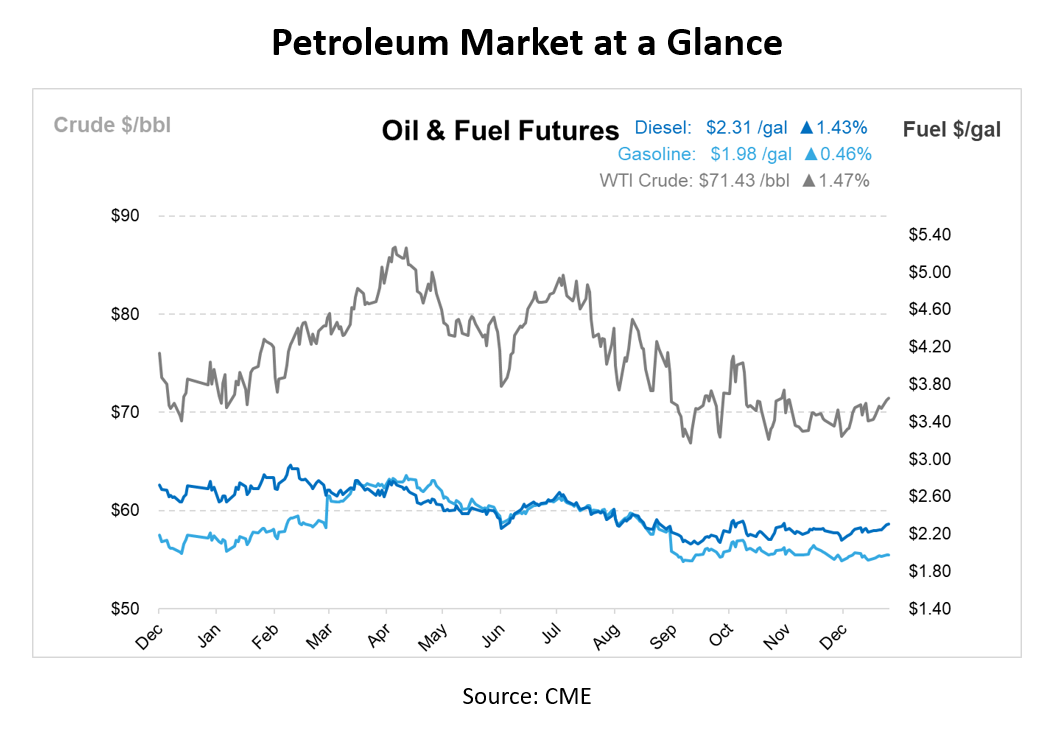

Oil prices are being influenced by a range of factors, with US market dynamics playing an important role. Diesel prices rose by 2.5%, reaching $2.30 per gallon, their highest level since early November. This increase reflects growing demand for diesel, driven by forecasts of colder weather across the US and Europe, which has boosted diesel’s role as an alternative heating fuel to natural gas.

Crude stockpiles are expected to have fallen by approximately 3 million barrels last week, according to preliminary estimates. This decline is largely driven by increased refinery activity as operators ramped up production to meet higher holiday-season fuel demand. Additionally, brent crude futures closed at $74.39 per barrel for February delivery, with March contracts settling slightly lower at $73.99 per barrel. WTI crude rose to $70.99 per barrel.

Degree days, a key measure of energy demand for space heating, are projected to increase significantly over the next two weeks, rising from earlier forecasts of 399 to 499. This sharp rise in anticipated energy needs has also pushed US natural gas futures up by 17%, their highest level since January 2023. These weather-related trends are expected to continue supporting oil prices in the short term as demand for diesel and heating fuels remains elevated.

Market positioning in the US also reflects shifting sentiment among industry players. WTI crude net length increased by 22,500 lots, driven by a notable rise in long positions and a slight decrease in short positions. In contrast, gasoline net length decreased by 10,700 lots due to a sharp reduction in long positions, while heating oil net length rose by 13,200 lots, driven primarily by a significant drop in short positions. These shifts highlight how traders are positioning themselves amid seasonal demand shifts and broader economic uncertainty.

Global factors are also contributing to price movements. In Nigeria, the Warri crude oil refinery resumed operations at 60% capacity after undergoing rehabilitation. With a maximum capacity of 125,000 barrels per day, the refinery is currently focused on producing kerosene, diesel, and naphtha. Efforts to restart Nigeria’s Kaduna refinery and restore operations at the Port Harcourt plant further add to regional supply considerations, particularly for diesel.

On the global economic front, China’s recovery signals are being closely monitored. The country’s non-manufacturing PMI rose to 52.2 in December, indicating an expansion in services and construction sectors. Manufacturing activity also grew for the third consecutive month, suggesting strengthening domestic demand after government stimulus measures. However, concerns remain about whether this recovery will sustain enough momentum to offset potential oversupply risks in 2024.

Geopolitical factors are also influencing market sentiment. Speculation around potential US policy changes, including tighter sanctions on Iranian crude oil exports, could remove over 1 million barrels per day from global markets. Such a reduction would likely tighten supply and support prices. Additionally, global market participants are closely watching economic data from China’s PMI factory surveys and the upcoming US ISM survey, which could provide further insights into the health of the world’s two largest oil-consuming economies.

As the year draws to a close, economic signals from the US and China, along with geopolitical risks, will continue to play a crucial role in determining the trajectory of oil prices in the weeks ahead.

This article is part of Daily Market News & Insights

Tagged: cold weather, oil prices

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.