Could Another Supercycle Be on the Horizon for 2025?

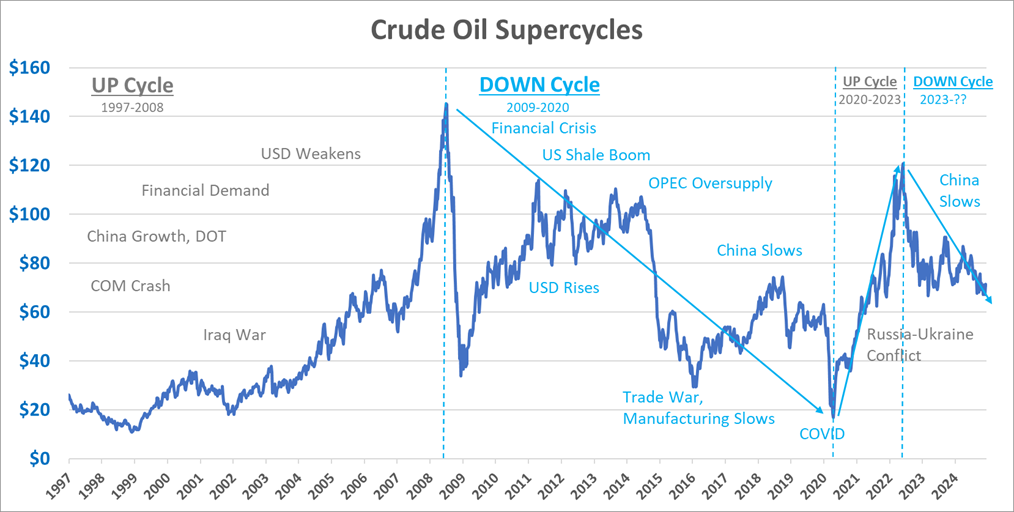

Markets tend to move in broad trends – either soaring upwards or careening lower. As we covered most recently in 2022, oil markets have gone through long trends where prices seem overwhelmingly to move in one direction. After bottoming out in 2020, crude oil prices skyrocketed to historic highs in 2023 before beginning their current downward shift. Depending on how the wind blows in 2025, crude oil could be heading toward another supercycle.

Questions are now being raised—is this the bottom of a down cycle or the start of a new up cycle? Alternatively, does the market still have room to fall in the current down cycle? With the ongoing Russia-Ukraine war, growing global fuel demand, a slowing Chinese economy, and the policies of the Trump administration shaping the energy landscape, the direction of crude prices remains uncertain.

Why 2025 Could See a Supercycle

- Persistent Supply Constraints

Persistent supply constraints, driven by underinvestment in crude oil production, create a structural deficit that could keep supply tight into 2025, pushing prices higher. Crude oil’s inelastic demand—as a vital input for transportation, industry, and energy—means consumers cannot quickly reduce usage even as prices rise, further amplifying price increases. Additionally, low global inventories leave little buffer against supply shocks, increasing market sensitivity and driving prices upward as buyers compete for limited supply.

- The Role of Geopolitical and Economic Factors

Global geopolitical tensions, including the Russia-Ukraine war, Middle East conflicts, and strained U.S.-China relations, are disrupting energy markets and straining supply chains, making the U.S. a vital supply hub. Sanctions on Russian exports have redirected global demand to alternative sources, particularly U.S. crude from the Permian Basin. Despite persistent inflation and uncertainty over Federal Reserve rate cuts, the oil and gas sector remains resilient, supported by strong bond market performance and its role as an inflation hedge. With global inventories still below pre-pandemic levels, supply shortages are expected to persist into 2025.

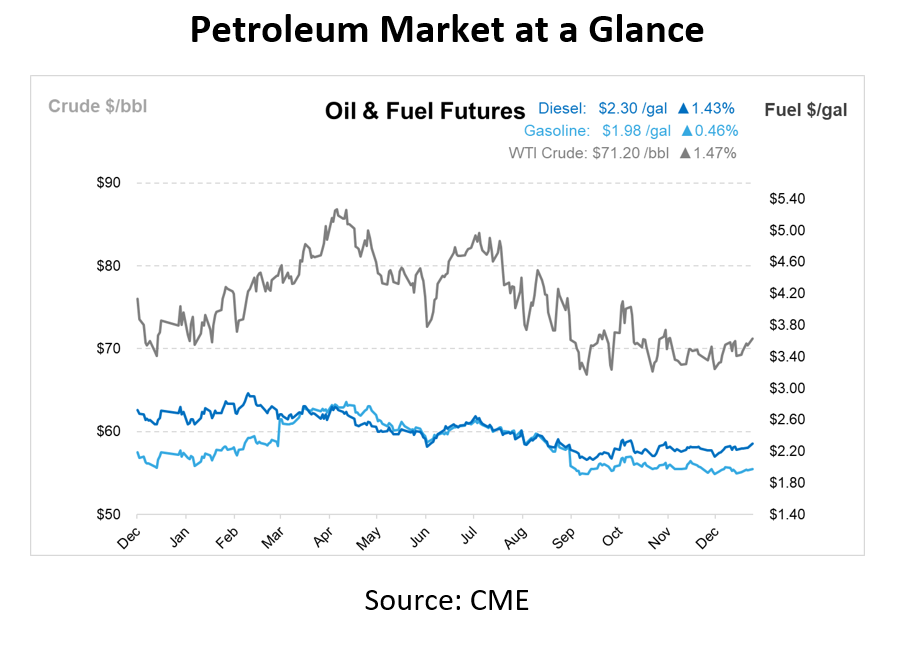

- Growing Demand and the Energy Transition

The energy transition is progressing, but it cannot keep up with the immediate growth in global fuel demand, particularly in emerging markets like India and China. These economies are expected to drive an uptick in demand over the next decade, keeping oil and gas central to the energy mix. Brent crude prices are expected to average $75 per barrel in 2025 according to the EIA, while WTI is forecasted to remain in the $70-$80 range. Despite China’s economic slowdown, its energy needs remain substantial, contributing to upward price pressure. Analysts anticipate that demand will outpace supply in 2025, creating conditions for a potential up cycle.

- Trump Administration Policies

The return of Donald Trump to the White House in 2025 introduces policy shifts that could influence crude oil markets. His administration is expected to prioritize energy independence, reduce regulatory barriers, and support increased domestic production. While these measures may stabilize prices in the short term by boosting supply, they could also set the stage for long-term structural shifts that impact the market trajectory.

Trump’s policies could lead to higher U.S. production by easing restrictions on drilling and expanding access to federal lands. This might mitigate global supply shortages and suppress prices, delaying a potential upcycle.

Trump’s foreign policy stance, particularly toward China, Russia, and the Middle East, could exacerbate or alleviate supply chain disruptions. For instance, tougher sanctions on adversarial nations could tighten global supply, while resolving conflict could prove more bearish. If tariffs are applied to crude imports, prices could rise; conversely, improved trade relations with allies could lift transportation demand and still cause prices to increase.

With a renewed focus on fossil fuels, Trump’s administration may deprioritize renewable energy development. This could sustain oil demand in the medium term, support higher prices, and create conditions for an up cycle. Conversely, stronger U.S. production, reduced demand from a slowing Chinese economy, and geopolitical de-escalation might keep prices contained, prolonging the current down cycle.

What This Means for the Energy Sector

The energy sector’s resilience despite global challenges proves its importance in both the current economic landscape and the predicted supercycle. Businesses and consumers alike should prepare for prolonged price volatility and potential record highs. It’s quite possible that 2025 could bring both unusually low prices and historically high costs. Energy-intensive businesses may need to adopt hedging strategies to mitigate rising costs.

As geopolitical conflicts and supply constraints persist, the global energy market remains primed for another supercycle, reinforcing the need for proactive planning and innovation to navigate the challenges ahead. Whether through continued consolidation, increased exploration, or advancements in efficiency, the energy sector will play a big role in shaping the economic narrative of 2025 and beyond.

This article is part of Daily Market News & Insights

Tagged: 2025, Daily Market News & Insights, Supercycle

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.