Prices Climb Ahead of Christmas – Will Holiday Cheer Spark Higher Prices in 2025?

FUELSNews will not be published tomorrow, December 25th, in observance of the Christmas holiday. Regular publication will resume on Thursday, December 26th. Mansfield wishes you a wonderful holiday!

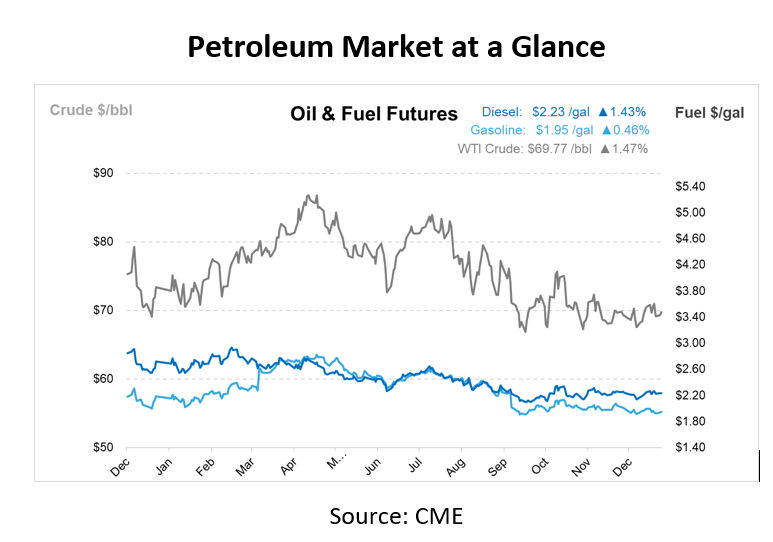

Oil prices are on the rise ahead of the Christmas holiday tomorrow, with WTI up over 50 cents to $69/bbl. Prices are expected to hold steady through the holiday season as trading activity slows. December’s supply and demand trends have reversed bearish pressures but warned that the market’s low positioning could lead to price spikes if any supply disruptions occur.

Looking ahead, forecasts for early 2025 suggest rising global oil demand, which may add upward pressure on prices. Recent projections from the EIA now anticipate a draw in global liquid balances next year, even as OPEC+ barrels re-enter the market, signaling tighter supply conditions. Adding to this outlook, China’s announcement of a $411 billion stimulus plan to support its economy could further stabilize prices and limit downside potential.

According to Rigzone’s What to Watch in Oil in 2025, geopolitical instability will remain a key driver of global markets in 2025, influenced by ongoing conflicts in the Middle East and Ukraine, shifting U.S.-China relations, and economic pressures like inflation and China’s slowdown. Global upstream investments are expected to decline by 2%, signaling a plateau, while offshore projects may see moderate growth. Conversely, shale and tight oil investments are projected to drop 8%, reflecting reduced activity and costs. Non-OPEC+ oil supply could grow by 1.4 Mbpd, causing oversupply and downward pressure on prices.

Clean energy and carbon capture markets are poised for growth, supported by policies and funding, particularly in Carbon Capture, Utilization, and Storage (CCUS) projects. However, infrastructure gaps and regulatory hurdles may slow progress. Low-carbon energy markets are expected to expand, though uncertainties around funding and policies could pose challenges.

Oil demand is projected to rise by 1 Mbpd, with refined fuel demand up 1.4%, driven mainly by emerging markets, while developed markets may contract. Economic risks, including inflation and trade disputes, could affect forecasts.

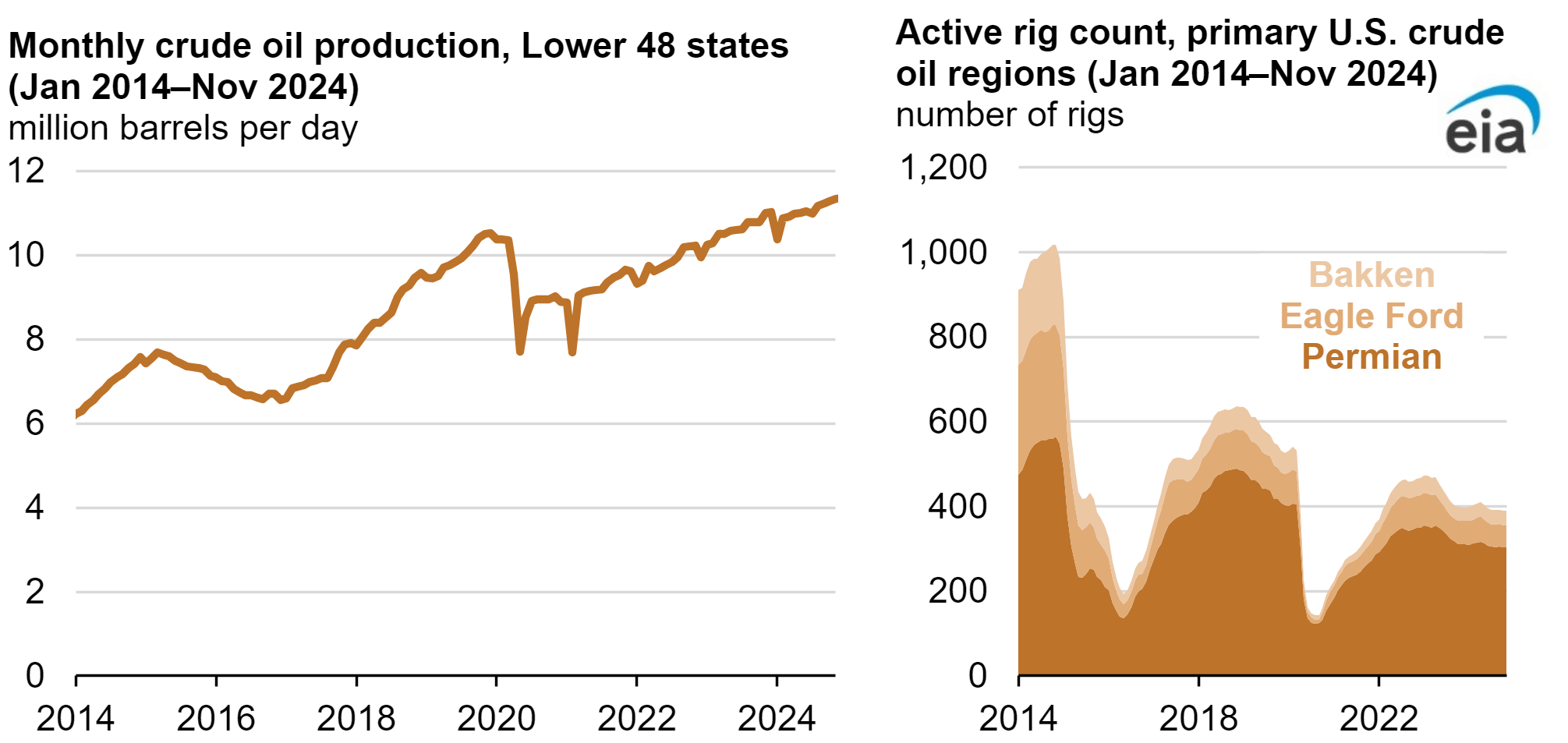

U.S. Lower 48 crude oil production reached a record 11.3 Mbpd in November 2024, despite a 3% decrease in active rigs, thanks to improved efficiency. Technological advancements, such as AI and automated drilling, have boosted productivity and reduced costs. The Permian Basin saw a 9% rise in crude oil output per rig, even as rig counts declined. Production is forecasted to grow by 260,000 bpd in 2025, aided by new pipeline capacity.

This article is part of Daily Market News & Insights

Tagged: Daily Market News & Insights, demand, eia, fuel prices, oil prices, opec, Supply, wti crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.