Natural Gas News – December 23, 2024

Natural Gas News – December 23, 2024

Mansfield Market Assessment

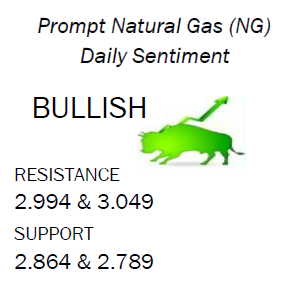

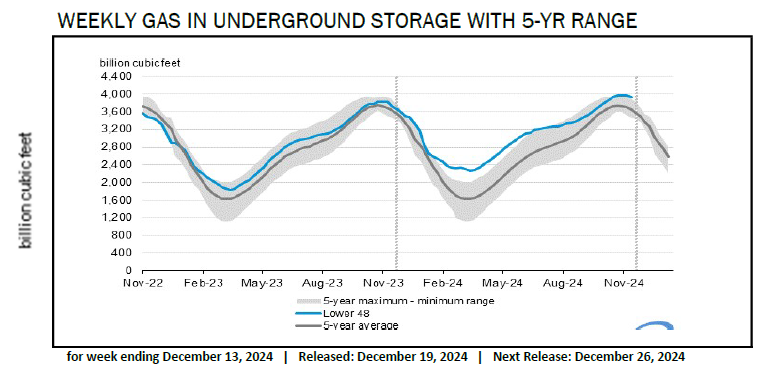

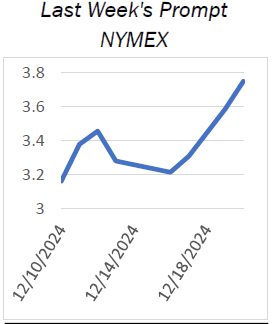

The market pushed up to 3.97 overnight testing the 4-dollar level. Effectively, there two camps in the weather community. One is calling for super cold to sweep across the nation lasting for two weeks. The other camp is calling for normal cold only lasting several days followed by a warmup. I expect a lot of volatility to continue thru the new year as the weather outcome becomes clearer. I will mention that over the last few years it has been hard to get locked in sustained cold for more than about 5 days. Production is holding in around 104 Bcf/day and I expect that to go even higher as the elevated prices will incent Producers to turn on more.

Will Supply Surplus Weigh on 2025 Price Outlook?

Oil and natural gas prices rise amid easing U.S. inflation but face longterm pressure from 2025’s supply surplus forecast. Natural gas breaks out of an ascending triangle; $3.775 support holds, with $3.989 and $4.262 as key resistance levels. WTI crude consolidates near $69.81; breakout above $70.48 could push prices to $71.46, while $69.38 acts as pivot support. Oil and natural gas prices edged higher this week, supported by easing U.S. inflation and improved risk sentiment. However, the energy market faces contrasting pressures. While geopolitical tensions sustain price volatility, a forecasted supply surplus for 2025 tempers long-term price expectations. The resumption of key pipeline operations in Europe alleviated immediate supply concerns, while money managers increased net-long U.S… For more info go to https://tinyurl.com/3v8hap2v

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.