Week in Review – Trump Targets EU Oil Trade & India Tops Global Oil Demand

Crude oil futures are down over 20 c/bbl this morning, capping off a week where prices dropped $2.50. Several developments in the US energy sector are influencing market sentiment this week, including President-elect Donald Trump, who has urged the European Union to address its trade deficit with the US by purchasing American oil and gas, warning of potential tariffs if these demands are not met. The US has also expanded sanctions targeting the Iranian oil trade, adding nine vessels and eight companies to the sanctions list, reflecting continued efforts to curtail Tehran’s oil exports and assert economic pressure.

Congress faces a deadline today to pass a temporary funding bill to avoid a government shutdown. Yesterday’s House rejection of a proposed plan heightened uncertainty and cast a shadow over broader economic and energy policy stability.

Meanwhile, the Department of Energy’s latest report highlights mixed inventory dynamics. There was a 0.9 million-barrel draw in crude oil stocks, with a slight 0.1 million-barrel build at Cushing, OK. Gasoline inventories rose by 2.3 million barrels, while distillate stocks saw a significant 3.2 million-barrel draw, likely driven by strong diesel demand. Refinery utilization decreased by 0.60% to 91.8%. While diesel exports and production remain stable, demand spikes—potentially storm-related—appear to be depleting distillate inventories. This trend could increase refinery netbacks and mitigate oversupply risks seen during the previous holiday season.

The recently introduced funding bill includes a provision to allow year-round sales of E15 gasoline. Advocates tout this move as a step toward regulatory certainty and increased demand for higher ethanol blends, though challenges like infrastructure readiness could hinder its widespread adoption. Additional provisions include Renewable Fuel Standard (RFS) compliance credits for small refiners previously denied exemptions and measures to review renewable fuel credit markets to prevent manipulation.

On the international stage, India has overtaken China as the largest contributor to global oil consumption growth. In 2024, India accounted for 25% of global growth, with an increase of 220,000 bpd, compared to China’s 90,000 bpd. This marks a milestone for India’s expanding energy needs and its growing role in the global oil market.

Geopolitical uncertainties, including U.S.-China relations and Middle Eastern conflicts, are expected to influence energy markets in 2025. Despite predictions of global oversupply, trends such as rising non-OPEC+ production and restrained U.S. shale activity are creating a complex supply-demand balance. OPEC+ remains cautious about potential increases in U.S. output under the incoming Trump administration, which could weaken its market leverage.

Prices in Review

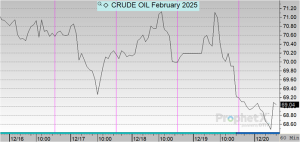

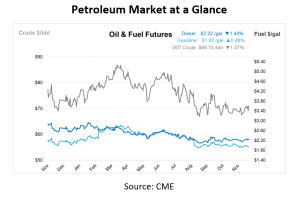

Crude oil opened the week at $71.44 before beginning its descent for the week. This morning, crude oil opened at $69.23, an overall decrease of $2.21 or -3.09%.

Diesel opened on Monday at $2.2719 and saw modest drops until Thursday morning, opening once cent higher than Wednesday. This morning, diesel opened at $2.2316, and overall drop of 4 cents or -1.77%.

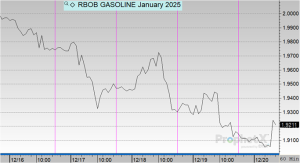

Gasoline opened the week at $1.9974 and experienced declines throughout the week. Gasoline opened at $1.9170 this morning, accounting for an overall 8 cent decrease or -4.02%.

This article is part of Daily Market News & Insights

Tagged: crude, Daily Market News & Insights, gasoline, oil prices, U.S., wti crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.