Week in Review – OPEC+ Extends Cuts; Oil Prices Drop Amid Surplus Concerns

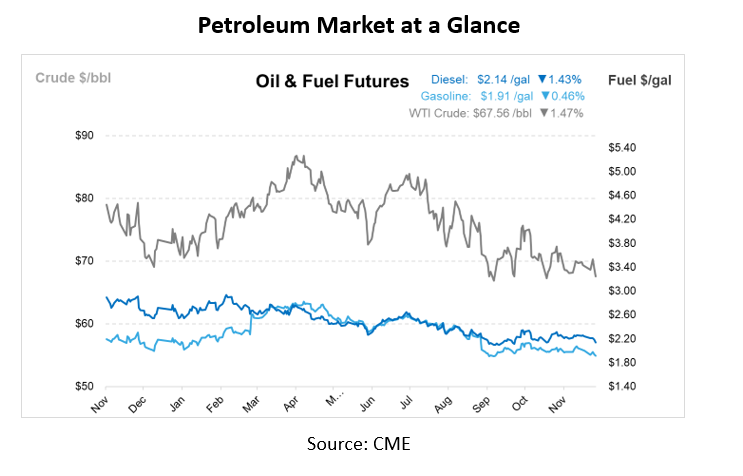

Oil prices have been under pressure this week, with key market events contributing to a downward trend. This morning, Brent crude futures are trading at $71.32 per barrel, while US West Texas Intermediate (WTI) is at $67.56 per barrel. Despite OPEC+ extending production cuts and postponing planned supply increases, concerns about an oversupply in 2025 continue to weigh on prices.

During the December OPEC+ meeting, member countries agreed to extend their voluntary production cuts of 2.2 million bpd for another three months, pushing the new deadline to April 2025. Additionally, the group outlined a gradual reversal of these cuts, which will now extend over 18 months, ending in September 2026 instead of the original December 2025 timeframe.

Despite this agreement, analysts remain cautious. Some predict an oil surplus in 2025, which is contributing to the downward pressure on oil prices. For example, Bank of America projects that Brent crude will average $65 per barrel in 2025 due to increasing surpluses, while HSBC predicts a smaller surplus of 0.2 million bpd.

On the ground, the United Arab Emirates (UAE) has agreed to delay the return of its production, opting instead to gradually increase output by 300,000 bpd from April 2025 through September 2026. While these moves by OPEC+ are designed to stabilize the market, concerns about sluggish global demand, particularly in China, and rising output from non-OPEC+ countries continue to weigh on prices.

In the United States, diesel production has reached new heights, driven by strong refining margins and an uptick in exports. US distillate fuel exports, which include diesel and gasoil, surged to 1.55 million bpd in the week ending November 29, the highest seasonal level since November 2018. This rise is largely due to tight supply in Europe and increasing U.S. refinery production.

Diesel exports to the Amsterdam-Rotterdam-Antwerp (ARA) region in Europe, a major refining and trading hub, are also expected to hit all-time highs in December, surpassing 250,000 bpd. This marks a significant increase compared to the average 28,000 bpd in exports from January to October. Europe’s diesel demand remains robust, particularly as supplies from Russia have diminished due to the ongoing embargo following Russia’s invasion of Ukraine.

This uptick in US diesel exports is supported by strong refinery utilization rates. As of November 29, the US refinery utilization rate stood at 93.3%, well above the five-year average of 87%. The tightening supply in Europe, coupled with improving arbitrage economics for U.S. diesel, suggests that transatlantic diesel flows could continue to rise.

Geopolitical Factors and the Russian Situation

Geopolitical tensions also continue to impact oil markets. In Libya, crude production has reached its highest level in over a decade, surpassing 1.4 million bpd, driven by a combination of improved infrastructure and political stability. Meanwhile, in Russia, crude oil flow has resumed through the Druzhba pipeline, which supplies a refinery in the Czech Republic. This resumption follows a temporary stoppage earlier in the week, further highlighting the geopolitical volatility that continues to influence oil markets.

U.S. Jobs Report and Economic Indicators

The US economy has also had an indirect impact on oil prices, with stronger-than-expected job growth helping to sustain demand expectations. November nonfarm payrolls are estimated to have increased by 235,000, higher than the consensus forecast of 215,000. This robust job creation, coupled with a stable unemployment rate of 4.1%, suggests that the US economy is maintaining a solid pace of growth, which could support oil demand in the coming months.

Additionally, the US trade deficit narrowed in October, and the economy is expected to grow at a rate of 2.4% in the fourth quarter, supporting the notion that economic conditions could remain favorable for oil demand.

Prices in Review

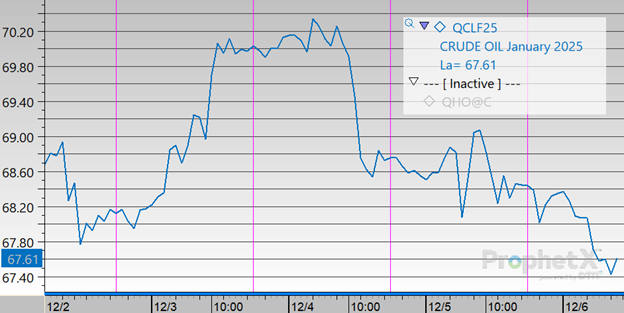

Starting at $68.94 on Monday, crude prices saw a slight increase on Tuesday, reaching $68.97. By Wednesday, prices jumped to $70.06, marking the highest point of the week. However, by Thursday, it dropped to $69.07, before falling further to $67.60 on Friday, a decrease of $1.34, or about 1.94%.

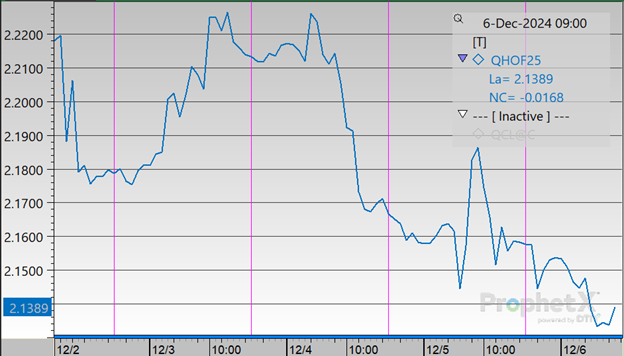

Diesel prices saw minor fluctuations throughout the week. Opening at $2.1882 on Monday, prices increased slightly to $2.2037 on Tuesday and then edged up to $2.2054 on Wednesday. On Thursday, prices dropped to $2.1864, before falling further to $2.1349 on Friday, representing a decrease of $0.0533, or about 2.4%.

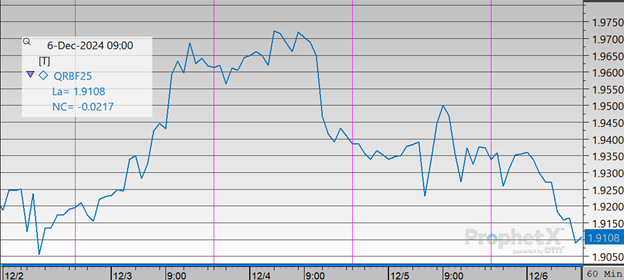

Gasoline prices experienced some ups and downs throughout the week. Starting at $1.9124 on Monday, prices rose by 3.5 cents to $1.9430 on Tuesday, and then increased further to $1.9703 on Wednesday, marking the highest point. On Thursday, prices dropped by $2.7 cents to $1.9501, and by Friday, they fell another 4.0 cents to $1.9098, an overall decrease of 2.6 cents, or about 0.14%.

This article is part of Week in Review

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.