Natural Gas News – December 06, 2024

Natural Gas News – December 06, 2024

Futures Decline Amid Supply Surplus & Weather Trends

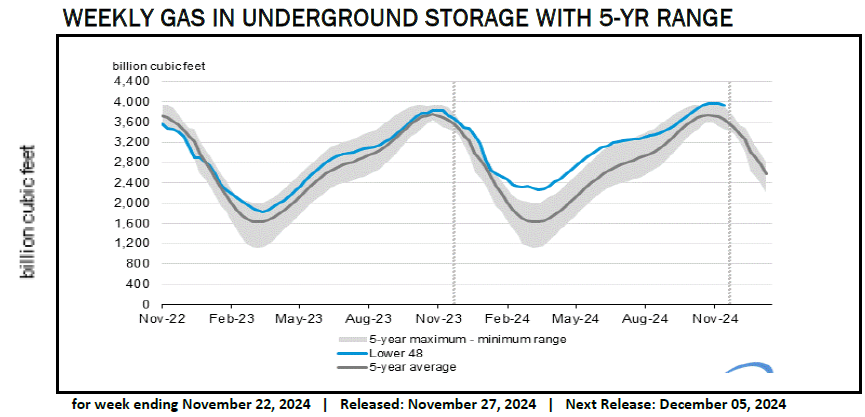

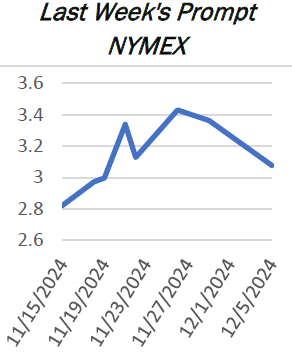

Natural gas inventories start winter at 3,922 Bcf, the highest since 2016, raising concerns over price pressure. US storage levels 6% above the five-year average point to robust supply, overshadowing weaker injection volumes. Mild weather forecasts dampen demand expectations, weakening support for natural gas prices in the coming weeks. Futures break below $3.133, with bearish momentum signaling potential drops toward $2.762 and $2.588. Midwest frost drives short-term demand, but warming trends in extended forecasts keep prices under downward pressure. Natural gas futures extended losses for a third consecutive session on Wednesday, slipping below key technical levels. The market now faces pressure from robust supply levels and moderated weather demand, reinforcing a bearish outlook for traders… For more information, go to https://tinyurl.com/2jpt7pdj

Why Has the USA Natural Gas Price Been Dropping Lately?

Natural gas prices are drifting lower after failing to break out above a key technical level at $3.40 per million British thermal units (MMBtu) last week. That’s what Art Hogan, Chief Market Strategist at B. Riley Wealth, said in an exclusive interview with Rigzone on Wednesday, when asked why the U.S. natural gas price has been dropping lately. “While the weather remains colder than usual, especially in the Northeastern U.S., which is the biggest driver of natural gas demand, the current driver of the commodity seems to be technical versus fundamental,” he added. Hogan warned that the next level of major technical support is $2.80 per MMBtu. For more information, go to https://tinyurl.com/5498ydvw

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.