Oil Prices Face Pressure as Demand Worries and Oversupply Challenge OPEC Efforts

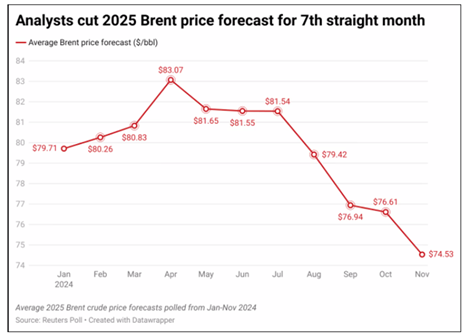

Oil prices are expected to face significant challenges in 2025 as weaker-than-anticipated global demand growth and abundant supplies weigh on the market. A Reuters survey of 41 economists and analysts predicts Brent crude will average $74.53 per barrel next year, a downward revision from October’s forecast of $76.61. This marks the seventh consecutive reduction in expectations for the global benchmark, which will average $80 per barrel in 2024.

US crude prices are also projected to decline, with the 2025 average forecast at $70.69 per barrel, lower than last month’s estimate of $72.73. Analysts attribute these adjustments to growing concerns over China’s economic performance, the global demand outlook, and OPEC+’s ability to manage supply effectively.

Demand Concerns

China, the world’s largest oil consumer, has been a focal point for market concerns. While recent stimulus measures are expected to support demand, structural economic issues and the rapid adoption of new energy vehicles are limiting growth.

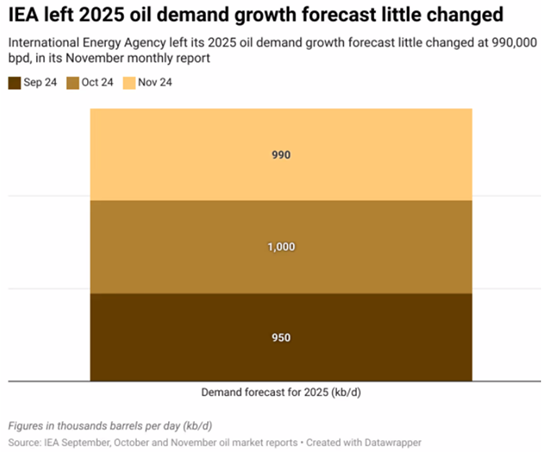

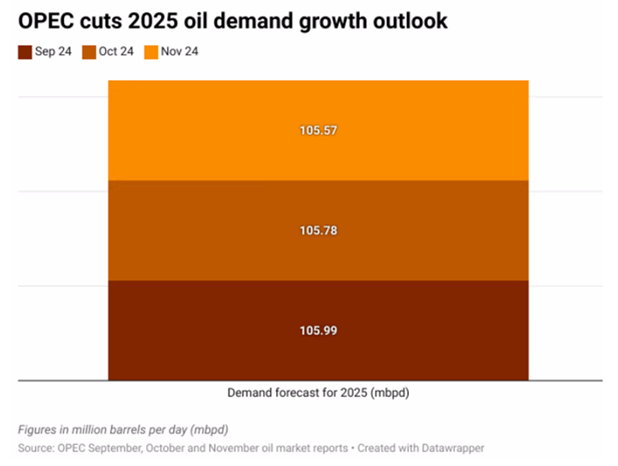

OPEC recently revised its global oil demand growth forecast for 2024 and 2025, citing weakness in China, India, and other key regions. However, global demand is expected to grow by 1 million to 1.5 million barrels per day (bpd) in 2025. The International Energy Agency (IEA) predicts that global supply will exceed demand, even if OPEC+ continues its production cuts.

OPEC+ Policy in Focus

The Organization of the Petroleum Exporting Countries and its allies (OPEC+) are set to meet on December 5 to decide production levels for early 2025. Analysts expect the group to extend its current output cuts through April 2025, potentially delaying planned production increases. “We do not rule out OPEC+ postponing the output increases until later in the year, given oil prices in the low $70s per barrel,” said Kim Fustier, head of European Oil & Gas Research at HSBC.

The group, which accounts for nearly half of global oil production, has been implementing production cuts to stabilize prices in the face of oversupply and subdued demand. However, the effectiveness of these measures remains to be determined, especially as global supplies remain robust.

Geopolitical Factors and Sanctions

Geopolitical risks, including tensions in the Middle East and potential U.S. sanctions on Iran, could influence market dynamics but are unlikely to support prices. “Iranian exports may slow, which would leave room for an increase from other producers so that the net impact will be limited,” said Ole Hansen, head of commodity strategy at Saxo Bank.

Stricter US sanctions on Iran could tighten supply, but analysts believe this would only have a minor impact, given the current state of the market. Instead, the focus remains on how OPEC+ and other producers manage the delicate balance between supply and demand.

Market Outlook

The outlook for 2025 highlights the ongoing uncertainty about global economic conditions and energy transitions. While China’s growth trajectory remains central, other factors, such as the rise of renewable energy and efficiency improvements in transport and industry, are also reshaping demand patterns.

Therefore, analysts will closely monitor OPEC+’s December meeting for signals on production. The group’s ability to align supply with demand and stabilize prices remains challenging. Brent and WTI prices may remain around current levels unless economic conditions improve significantly, or supply is cut more aggressively.

With Brent averaging $80 per barrel so far in 2024, the anticipated declines for 2025 highlight the market’s cautious outlook amid demand uncertainties and persistent oversupply.

This article is part of Daily Market News & Insights

Tagged: demand, oil prices, opec, Oversupply Challenge, Supply

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.