Lower Fuel Prices are Leading to the Busiest Thanksgiving in Years

Thanksgiving 2024 is shaping up to be one of the busiest travel weeks in recent history, with AAA projecting almost 80 million Americans will journey 50 miles or more. This represents a 1.7 million increase over last year and 2 million more than pre-pandemic 2019. The holiday travel period now spans from the Tuesday before Thanksgiving to the Monday after, providing a more comprehensive view of travel trends.

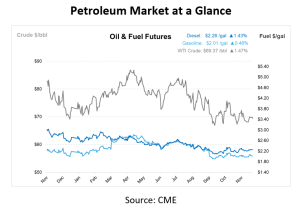

The vast majority of travelers—71.7 million—are expected to hit the road this Thanksgiving, an all-time high that surpasses pre-pandemic levels. Lower gas prices are likely fueling this increase. The national average price for gasoline has dropped to $3.01 per gallon, its lowest since May 2021. This is part of a six-week streak of declining prices, with states east of the Rockies offering some of the most competitive rates, ranging from $2.25 to $2.50 per gallon. Diesel is nearly 70 cents cheaper than the year-ago average, sitting at a current US retail average of $3.55, according to AAA.

While road travel dominates, air travel is also reaching new heights, with 5.84 million people flying domestically, a 2% increase over 2022 and an 11% jump compared to 2019. The Transportation Security Administration (TSA) expects to screen 18.3 million passengers, marking a record-breaking Thanksgiving travel season. Peak travel days for flights include the Tuesday and Wednesday before Thanksgiving and the Sunday after.

Winter weather could create logistical hurdles for both road and air travel. Northern California and the Sierra Nevada are under winter storm warnings through midweek, with the Midwest and Northeast bracing for snow and icy conditions. On Thanksgiving Day, widespread rain and snow are expected across the eastern U.S., particularly in the Great Lakes, mid-South, and Ohio Valley.

Oil prices saw a slight increase this morning influenced by reports of a potential ceasefire between Israel and Hezbollah, which could reduce the risk of stricter U.S. sanctions on Iranian crude. Meanwhile, OPEC+ is expected to maintain current output cuts into 2024 on uncertain global demand.

The International Energy Agency (IEA) projects ample oil supplies unless a major geopolitical escalation occurs, giving commercial buyers some confidence in near-term market stability. However, potential policy shifts under President-elect Donald Trump—including a 25% tariff on imports from Mexico and Canada—could impact fuel pricing and supply chains. Analysts believe Canadian crude, which accounts for most of Canada’s 4 Mbpd of exports to the U.S., is unlikely to face tariffs due to its unique characteristics.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.