Week in Review: U.S. Election, Fed Rate Cuts, and China Demand Shape the Week

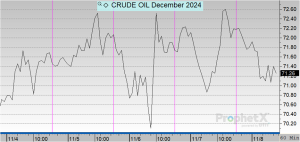

This week, WTI crude oil futures experienced notable volatility as markets responded to the U.S. Presidential election results and broader economic signals. Despite an early-week dip, December WTI crude gradually climbed, peaking at $72.36/bbl on Thursday—a 67-cent increase. This upward momentum marks the sixth increase in oil prices over the past seven sessions. However, this morning saw WTI crude slip by over a dollar per barrel, suggesting continued sensitivity to economic and geopolitical factors. The week’s fluctuations emphasize the complex forces shaping energy markets as they adjust to potential shifts in U.S. energy policy and global demand expectations.

A declining U.S. dollar on Thursday pushed energy prices higher, which had increased Wednesday after Donald Trump won the U.S. presidential election. In the Gulf of Mexico, traders were also keeping an eye on Hurricane Rafael’s approach. The storm is still in the Gulf but is predicted to move west toward Mexico, which would decrease its influence on Gulf oil drilling and refinery activities. Markets are also processing the impact of the US Federal Reserve’s 0.25% interest rate cut even though it was expected to happen.

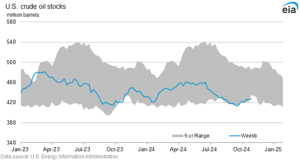

With a 1.4% elevation, refinery utilization showed substantial growth and contributed to product builds in both diesel and gasoline. Crude inventory levels are worth monitoring as they are far below the five-year average. Since the scheduled fall refinery shutdown is over, the US should keep increasing utilization, which would further deplete the crude stockpiles. Normally, it would be alright but take notice that our total U.S. crude stock levels are low. Domestically, U.S. production is still doing rather well, therefore the outcome of the global market balance—Chinese demand vs OPEC+ output—will determine the outcome. Although OPEC+ has now put off raising output until December, they could reverse their position at any time.

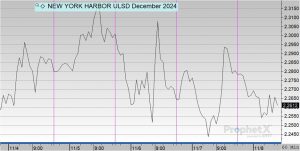

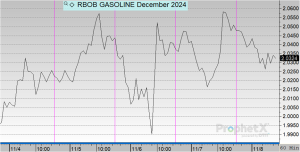

Outside of the United States, China continues to be pivotal for global oil demand driven by its petrochemical industry, even as the country’s fuel consumption for road transportation plateaus with the energy transition. China’s gasoline demand appears to have peaked, with modest growth of 22,000 bpd in 2024, down from 268,000 bpd in 2023, due to increased new energy vehicle sales. Diesel demand in trucking is influenced by LNG pricing, but recent narrowing in the LNG-diesel price gap has reduced LNG truck sales, casting uncertainty on its growth as a transport fuel alternative.

In parallel, China’s crude oil imports have dropped for the sixth consecutive month, decreasing by 9% in October to 10.53 Mbpd, mainly due to refinery closures and weaker demand among smaller refiners facing slim margins. Refined product exports, including diesel and gasoline, dropped 23% year-over-year in October, reflecting domestic consumption adjustments and lower refinery output.

Prices in Review

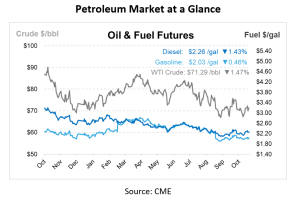

Crude opened on Monday at $70.29 and showed moderate gains throughout the week despite a sharp decline in Wednesday trading after the US Presidential election. This morning, crude oil opened at $72.21, an increase of $1.92 or 2.73%.

Diesel opened the week at $2.2457 and saw upward momentum until Thursday trading. This morning, diesel opened at $2.2796, an overall increase of 3 cent or 1.5%.

Gasoline opened on Monday below $2 at $1.9815, and saw marginal increases until yesterday. This morning, gasoline opened at $2.0499, an increase of 6 cents or 3.45%.

This article is part of Daily Market News & Insights

Tagged: crude, demand, diesel, fuel prices, gas prices, gasoline, U.S., wti crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.