What’s Changing in the Oil Market in 2024? Here’s what you need to know

As we progress through 2024, the oil market faces significant changes influenced by shifting demand, supply dynamics, and geopolitical factors. Unlike 2022, which experienced substantial supply chain disruptions and production challenges, the current focus has shifted to the implications of changing demand patterns within the US market and also globally.

According to Andy Milton, Senior Vice President of Supply & Distribution at Mansfield Energy, the current state of the industry requires careful analysis of various factors. In today’s article, we’ll explore the factors affecting diesel demand, US crude production, and refining capacity, as these elements interact with global trends and domestic shifts that are essential for grasping the current landscape of the industry.

Current Demand Dynamics

The discussion begins by recognizing the relatively low energy prices in the US compared to global benchmarks. As demand challenges surface, it’s essential to monitor several key factors. Andy Milton explains that “after significant improvements in supply since 2022, the focus is shifting to how ongoing economic conditions will affect diesel demand.”

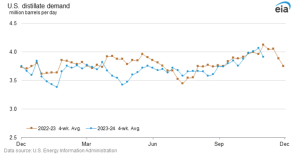

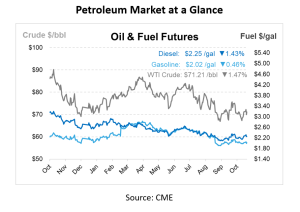

Recent U.S. Energy Information Administration (EIA) data indicates that distillate demand, which includes diesel and heating oil, has decreased by approximately 5.32% compared to the same period last year (Nov. 03, 2023 and Nov. 01, 2024), which aligns with Andy’s observations. This result is tied to broader economic challenges, including a slowdown in industrial production and transportation activity. However, it is important to note that we have seen a small increase in US diesel demand in the past few weeks, mostly influenced by Federal Reserve interest rate cuts and relatively cheap energy costs.

As companies adjust their operations in response to economic uncertainty, diesel consumption is likely to remain under pressure in the short term.

The seasonal demand uptick and exports volume have made the Days of Supply for diesel fuel dip considerably, maintaining below 30 day for three weeks.

US Crude Production and Global Context

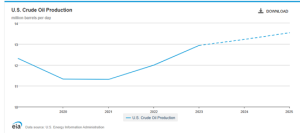

US crude production has seen a revival, consistently surpassing 13 million barrels per day, which is favorable for domestic energy prices. While US production is robust, Andy Milton explains that the dynamics of the OPEC+ strategy to keep output cut remain critical, especially to ease concerns about potential oversupply. Even small changes in supply, like 200,000 barrels per day, can significantly impact global oil prices, given the daily global demand of approximately 100 million barrels.

The US is the world’s leading oil producer. According to the Statistical Review of World Energy, the U.S. produced 15.6% of the world’s oil in 2023. However, Russia and Saudi Arabia rank as the second and third largest producers globally, respectively, and both are members of OPEC+. Moreover, several of the top 10 global producers belong to OPEC. When combined, these countries accounted for nearly 50% of global oil production in 2023.

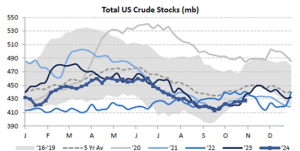

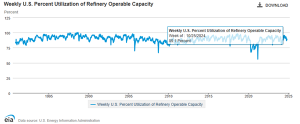

Refinery utilization saw a significant improvement, with a 1.4% increase that contributed to builds in distillate products. The actual inventory changes include a 2.1-million-barrel build in crude (with a 0.5 million barrel build at Cushing), a 0.4 million barrel build in gasoline, and a 2.9 million barrel build in distillate, bringing refinery utilization to 90.50%. “It’s important to monitor crude inventory levels, especially as we have moved past planned fall refinery downtime, which should lead to further increases in utilization and a reduction in crude inventories. While this trend is generally positive, it’s noteworthy that Total US crude stocks are relatively low. US production remains healthy, but the overall market balance will depend on global factors, particularly Chinese demand and OPEC+ production levels.” Explains Andy.

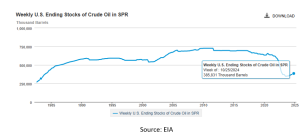

The Strategic Petroleum Reserve (SPR) has also been a focal point, with significant withdrawals in the past few years aimed at stabilizing prices. However, Andy notes that “the impact of this strategy on international relations, particularly with OPEC nations, cannot be understated. The depletion of the SPR has been seen as a measure to lower prices domestically while complicating relationships with oil-producing countries.”

Refining Capacity in the U.S.

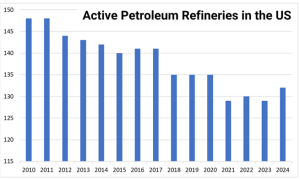

The US refining landscape has changed significantly over the past few decades. The number of operational refineries has declined from around 300 in the 1980s to approximately 132 today, with more planned closures to come. In October,

LyondellBasell Industries has also announced its intention to close its Houston oil refinery, which has a capacity of 268 kb/d, in the first quarter of 2025. Located in Texas, this refinery has been producing transportation fuels such as gasoline, diesel, and jet fuel since it began operations in 1918, making it one of the oldest refineries still in operation in the United States. While LyondellBasell originally planned to shut down the Houston refinery by the end of 2023, it later postponed those plans.

According to Andy, the reduction in the number of refineries has created a more concentrated market, which raises concerns about competition and potential supply shortages, particularly in niche markets where only a few refineries operate. He emphasizes that fewer refineries mean less competition, which could impact pricing and availability for consumers.

Despite these challenges, US refining capacity has remained relatively stable, with utilization rates hovering around 89-92%. However, Andy cautions that the refining capacity may be peaking, with no significant expansions expected in the near future. This cap on capacity could lead to tighter supplies if demand increases unexpectedly or if refineries experience unplanned outages.

Andy also notes the impact of mergers and acquisitions (M&A) in the refining sector, which have been significant in recent years. These consolidations can lead to greater operational efficiencies, but they may also result in fewer players in the market, potentially constraining supply and impacting prices. The high costs of maintaining and upgrading existing facilities, alongside regulatory pressures, are contributing to the industry’s cautious outlook.

Challenges and Opportunities

Looking forward, the potential for volatility in diesel prices is anticipated to persist due to various factors:

- Economic Conditions: Ongoing economic pressures may lead to fluctuating diesel demand, which, combined with tight supply in certain regions, could drive prices up or down unpredictably.

- Geopolitical Factors: Events in the Middle East and decisions made by OPEC and OPEC+ will continue to impact global oil prices. Any escalation in conflicts or changes in OPEC strategy will need to be monitored closely.

- Refinery Economics: As refining margins tighten, there are concerns that less profitable refineries may cease operations, further constraining supply in specific areas.

- Renewable Fuels Impact: The growing emphasis on renewable diesel presents both opportunities and challenges. As regulations evolve, the market dynamics for renewable fuels will significantly affect traditional diesel consumption patterns.

Andy Milton, Senior Vice President of Supply & Distribution at Mansfield Energy, spoke at the D1 Expo 2024, where he provided an overview of the current oil industry and shared insights on future developments. At Mansfield Energy, Andy is responsible for all fuel procurement and overseeing daily fuel purchase optimization. His experience encompasses all aspects of the fuel supply chain, including truck dispatch, analytics, index pricing, hedging, and bulk purchasing.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.