Week in Review: Oil Prices Climb 3% While Diesel Demand Drives Supply Tightness

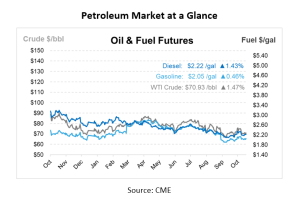

Oil prices are on track for a weekly gain of about 3%, with crude futures rising Friday on fluctuating Middle East tensions and upcoming ceasefire discussions in Gaza. This morning, WTI crude rose over 70 cents to $70.93, while Brent increased 77 cents to $75.15/bbl. Markets experienced volatility this week, driven by expectations of supply risks and easing fears of disruption. Gulf Coast gasoline prices dropped nearly 6 cents, reflecting low margins for refiners, though West Coast prices rose by up to 7.5 cents per gallon. Diesel prices also saw slight declines, and retail gasoline neared $3 per gallon nationally. More than half of the nations retail stations are selling gasoline below that mark.

Markets are closely monitoring Israel’s potential response to an October 1 Iranian missile attack and the progression of U.S.-led ceasefire talks. Broader concerns also focus on China’s upcoming financial measures, though significant demand boosts for oil are not expected. Market sentiment remains divided between Middle Eastern supply risks and demand stability concerns globally.

Data from this week’s Department of Energy report aligns with broader market trends: a large crude inventory build as refinery utilization ramps up post-turnaround season, with diesel inventories continuing to draw down. The diesel draw highlights strength in diesel demand, driven in part by stable U.S. consumption and sustained export levels. This may also reflect a response to the Federal Reserve’s recent interest rate cuts aimed at stimulating economic growth, which could be bolstering industrial and transport fuel demand.

The continued rise in diesel demand, coupled with high export volumes, has pushed the Days of Supply for diesel fuel below the 30-day threshold. Although this drop in supply is likely temporary and should ease with increased production as refineries return to normal operations, it brings to face a tighter diesel market.

Markets will hope for signs of stabilization in the Days of Supply metric, as consistent demand and exports against refinery ramp-ups will play a role in balancing inventory levels. This tightness may introduce volatility, especially if demand remains steady, influencing prices and potentially signaling adjustments in domestic diesel allocation if inventory pressures persist.

Prices in Review

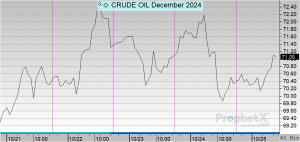

Crude started the week below the $70/bbl threshold at $69.46. Prices increased Tuesday and Wednesday, dropped off slightly on Thursday and this morning. Today, crude opened at $70.33, an overall increase of 87 cents or 1.25%.

Diesel opened the week at $2.1589 and saw steady increases until Thursday. The highest point for diesel this week was on Wednesday at $2.2324. This morning, diesel opened at $2.2119, an increase of 53 cents or 2.45%.

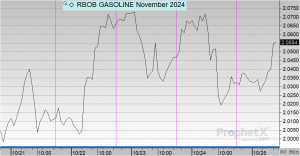

Gasoline opened on Monday at $2.0055, decreased slightly on Tuesday and climbed up on Wednesday to $2.0652. This morning, gasoline opened at $2.0340, an overall increase of almost 3 cents or 1.42%.

This article is part of Daily Market News & Insights

Tagged: Week in Review

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.