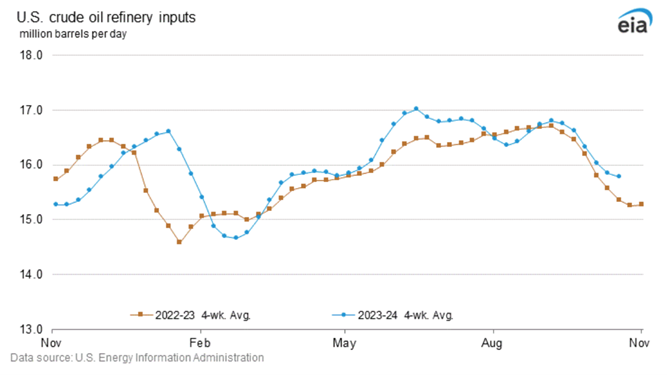

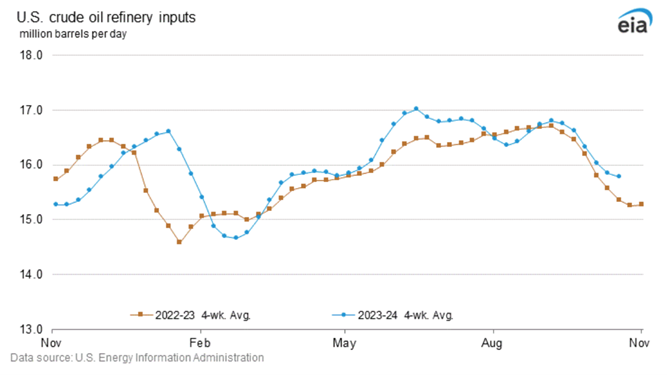

Refinery Utilization Remains Strong Amid Fall Maintenance Season

Recent data from the Energy Information Administration (EIA) reveals that the ongoing refinery maintenance season is shaping up to be one of the least impactful in years. As maintenance efforts wind down, crude oil and feedstock processing rates have risen, indicating a robust production landscape compared to previous years.

Gross inputs of crude oil and feedstock reached 16.395 million barrels per day (b/d), an increase from 15.634 million b/d during the same week last year. Notably, the Gulf Coast (PADD 3) has experienced the most significant surge, with refiners processing nearly 600,000 b/d more feedstock than this time in 2023. Similarly, the Rocky Mountains (PADD 4) saw processing rates climb by 62,000 b/d, approximately a 10% increase year-on-year. This heightened activity is expected to provide some relief to the region’s high gasoline and diesel prices.

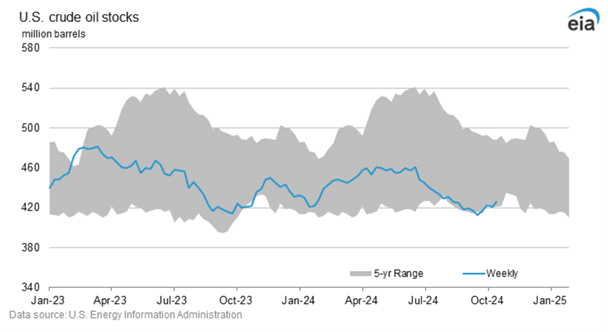

Crude Oil Stock Dynamics

The EIA’s report also noted a rise in US crude oil stocks, which increased by 5.5 million barrels last week. This uptick comes despite refiners operating at elevated rates compared to the previous year. The increase could indicate a well-supplied oil market as we move into the fourth quarter, particularly as the build was concentrated in PADD 3, which saw a rise of 4.4 million barrels. The West Coast also reported a notable increase, with stocks jumping by 2.3 million barrels.

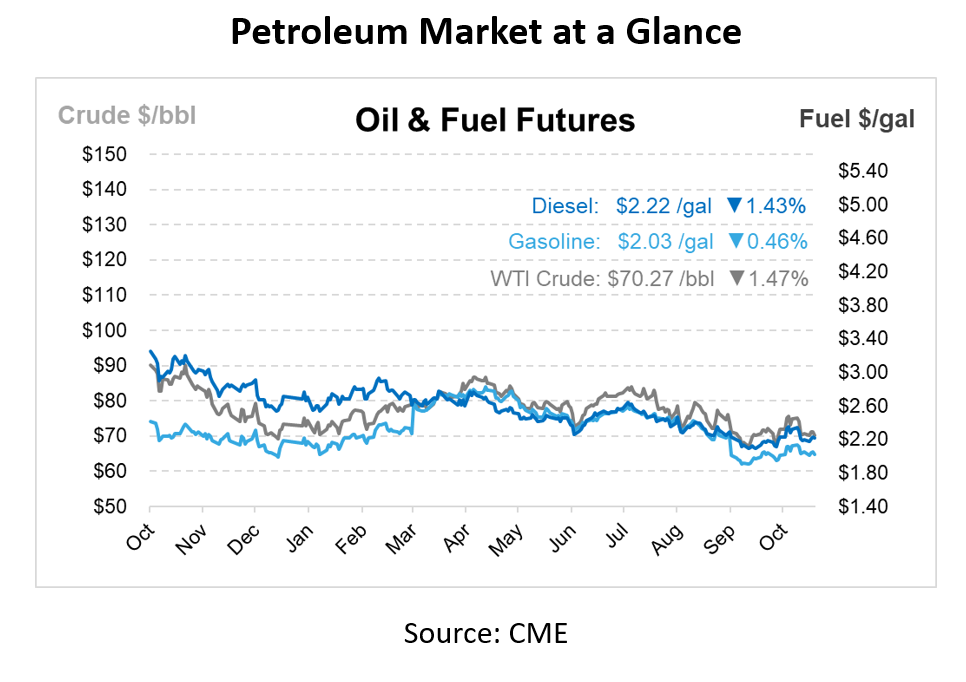

Distillate and Gasoline Production

Higher refinery runs have translated into a significant uptick in distillate production, which surpassed 5 million b/d last week. The Gulf Coast alone contributed a week-to-week increase of 251,000 b/d. However, despite this robust output, domestic distillate stocks fell by 1.1 million barrels to 113.8 million barrels, remaining above levels seen in 2022 and 2023. As the industry has previously managed stocks between 106 million and 112 million barrels, further builds are likely through November.

In terms of gasoline, inventories rose by 900,000 barrels last week, though the East Coast (PADD 1) market experienced a decline of 1.9 million barrels to 56.58 million barrels. This figure still surpasses last year’s levels, but the near-term outlook may be concerning as refiners, blenders, and importers push nearly 10 million b/d of motor fuel to the market. Year-to-date gasoline demand has been estimated at around 100,000 b/d higher than last year, though some market observers believe this may have been inflated due to panic buying in anticipation of Hurricanes Helene and Milton.

Export Market Dynamics

A consistent theme has emerged from recent reports: the export market continues to be a critical support system for both gasoline and distillate products. Currently, the US is exporting approximately one cargo of gasoline per day and around three cargoes of distillate. This trend suggests that while domestic demand may fluctuate, international markets provide a necessary outlet for excess production.

Jet Fuel Production Trends

Lastly, jet fuel production averaged about 1.771 million b/d last week, reflecting an increase of 140,000 b/d compared to the same week last year. Demand for jet fuel typically peaks during the summer and holiday seasons, indicating that while the aviation sector’s recovery is ongoing, production levels are already gearing up to meet seasonal demand.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.