Oil Prices Hold Steady Despite Middle East Conflicts

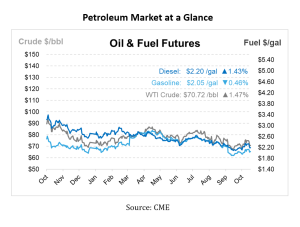

Oil prices are trading flat this morning, with Brent crude at $74.45 per barrel and US West Texas Intermediate (WTI) at $70.72 per barrel. These prices followed a largely unchanged close yesterday for the second consecutive day.

Middle East geopolitical developments have been a significant factor in oil price movements. Recently, Israel announced the killing of Hamas leader Yahya Sinwar, leading to heightened tensions in the region. Israeli Prime Minister Benjamin Netanyahu emphasized that “the war isn’t over,” which has kept concerns about potential retaliatory actions from groups like Hezbollah at the forefront. Analysts fear that further escalation could disrupt oil supplies, particularly if conflicts expand to involve major oil producers like Iran. The possibility of retaliatory strikes and broader regional instability continues to create an atmosphere of uncertainty that can affect oil pricing.

The U.S. Energy Information Administration (EIA) reported a crude draw of 2.2 million barrels for the week ending October 11, contrasting with a forecasted build of 1.8 million barrels. This draw indicates a tightening supply situation in the U.S., although overall U.S. crude oil inventories remain about 5% below the five-year average for this time of year. Additionally, weekly crude production hit a record high of 13.5 million barrels per day, raising concerns about market oversupply as rig counts remain low. Despite this increase, there are apprehensions that the growth in U.S. production could lead to an oversupplied market in the near future.

On the supply side, Saudi Arabia’s crude oil exports decreased to 5.67 million barrels per day in August, marking a 1.2% decline from July. This reduction reflects ongoing efforts by OPEC to manage supply levels and stabilize prices in the face of fluctuating global demand. Saudi Arabia’s strategy to cut exports is intended to support prices amidst concerns over a potential oversupply, especially with other OPEC members also facing production challenges.

Demand factors also weigh heavily on oil prices. China’s oil refining fell to a three-month low of 58.73 million tons in September, reflecting a 1.6% year-to-date decline. This decline is attributed to reduced gasoline consumption due to the growing adoption of electric vehicles and lowered diesel demand due to a slowdown in domestic construction. As the world’s largest oil importer, China’s economic performance significantly impacts global oil demand.

In the US, industrial production and manufacturing output declined more than anticipated in September, with motor vehicle assemblies decreasing by 2.3% to 10.8 million. This decline was largely driven by the Boeing strike and hurricanes impacting production capacity. Consequently, GDP growth estimates for the third quarter have been revised down to approximately 3.1%. However, core retail sales rose 0.7%, suggesting some resilience in consumer spending despite broader economic headwinds.

Looking ahead, oil prices are set for their largest weekly decline since early September, with benchmarks facing pressures from a combination of demand worries and easing supply risks from the Middle East conflict. OPEC and the International Energy Agency have also revised their global oil demand forecasts downward for 2024 and 2025, indicating a more cautious outlook for future consumption.

Prices In Review

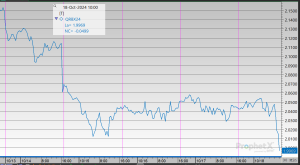

Throughout the week, crude prices experienced a noticeable decline, starting at $74.58 on Monday and fluctuating to a low of $70.29 on Wednesday. The most significant drop occurred on Tuesday, where prices fell to $70.40, marking a decrease of $4.18 from Monday. On Friday, prices opened at $70.45, which represents a decline of $4.13 or approximately 5.53%.

Diesel prices showed a downward trend throughout the week, starting at $2.2991 on Monday and reaching a weekly low of $2.1819 on Wednesday. The largest decline occurred on Tuesday when prices dropped to $2.2039. This morning, prices slightly rebounded to $2.1791, representing a decrease of $0.1200 or about 5.22%.

Gasoline prices fluctuated over the week, beginning at $2.1074 on Monday and dropping to a low of $2.0188 by Friday. The most considerable decline occurred on Tuesday when prices fell to $2.0239. By the end of the week, gasoline prices edged slightly upward but remained lower than the Monday figure. Overall, comparing the prices from Monday to Friday, gasoline experienced a loss of $0.0886 or approximately 4.20%.

This article is part of Daily Market News & Insights

Tagged: China, conflicts, Middle East, oil prices, Saudi Arabia’s crude oil exports, Supply, U.S.

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.