EIA Outlook: Strong Oil Production Despite OPEC+ Cuts

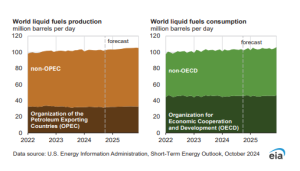

The Energy Information Administration (EIA) has indicated that while OPEC+ is likely to maintain its voluntary production cuts in 2025, however, global oil production is expected to increase significantly due to contributions from non-OPEC countries. In its latest Short-Term Energy Outlook (STEO), the EIA anticipates that producers across the globe will continue to boost output, resulting in a more balanced oil market in the coming years.

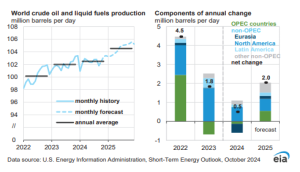

Despite the ongoing production limits from OPEC+, the EIA forecasts an overall increase of 2 million barrels per day (b/d) in global production of petroleum and other liquid fuels by 2025. Approximately two-thirds of this increase is expected to come from countries outside of OPEC+. The rise in production is anticipated to stem from increased output in the US, Canada, Brazil, and Guyana, which are collectively enhancing their oil production capacities.

Market Deficits and Inventory Trends

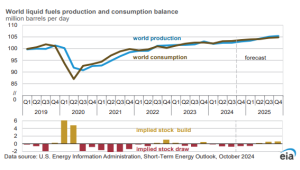

The EIA’s analysis indicates a significant drawdown in global oil inventories, estimating a reduction of 800,000 barrels per day (b/d) during the third quarter of this year, with an anticipated further decline of 600,000 b/d into the first quarter of next year. This trend highlights the tight balance in the market, as more oil is being consumed than is being produced.

In the US, gasoline stocks have plunged by 6.3 million barrels to a low for 2024, while distillate stocks have also seen a decrease of 3.1 million barrels. This marks the third consecutive week of declines in distillate inventories, with total reductions exceeding 6.6 million barrels over this period. Notably, despite the steep drop in gasoline stocks, US refinery production last week was sufficient to meet estimated demand, which reached 9.654 million b/d—the highest figure reported this year. This spike in gasoline demand may reflect increased purchases ahead of Hurricane Milton’s arrival.

Looking ahead, the EIA expects this deficit to be resolved, with oil supplies projected to increase by mid-2025. This anticipated rise in production will be driven primarily by OPEC+, alongside growth in non-OPEC+ producers such as the US, Canada, Guyana, and Brazil. The agency forecasts an overall increase in global production of petroleum and other liquid fuels by 2 million b/d in 2025, with about two-thirds of this growth expected to come from non-OPEC+ countries. OPEC+ is projected to contribute approximately 700,000 b/d to this increase, covering around 53% of the 1.3 million b/d removed from the market through voluntary cuts.

Future Supply Dynamics

By the second half of 2025, EIA projects that global inventories will start to recover, increasing by an average of nearly 600,000 b/d due to heightened production and a slowdown in global demand growth. In its latest Short-Term Energy Outlook (STEO), the EIA has revised its forecast for global liquid fuels consumption growth in 2025 downward to 1.3 million b/d, reflecting changing market conditions.

Moreover, the ongoing OPEC+ production cuts have left a significant surplus crude oil production capacity available, which could be activated in response to potential disruptions—particularly in light of the escalating tensions in the Middle East between Israel and Iran. While the EIA notes that no oil supplies have yet been impacted by increased military action in the region, the situation remains fluid, and the risk of supply disruptions and price volatility persists.

Demand and Export Dynamics

U.S. gasoline exports fell to 942,000 b/d last week, although they have remained above 900,000 b/d for three of the past five weeks. Conversely, gasoline imports dwindled to 428,000 b/d, marking one of the lowest rates of the year. Total gasoline inventories, while declining week over week, remain comfortably higher than the levels recorded during the same period in the past two years.

Distillate stocks also contracted in all U.S. markets, led by a drop of 1.4 million barrels in PADD 1 (East Coast). Despite a decrease in distillate exports, U.S. barrels continue to attract demand, with export volumes averaging 1.429 million b/d over the past four weeks—strong, though not at record levels.

Moreover, EIA data indicates a rise in US crude oil stocks by 5.8 million barrels last week, despite a decline in refinery runs and a production average of 13.4 million b/d. This build occurred even as imports decreased by 389,000 b/d, while U.S. oil exports fell for the third consecutive week to 3.794 million b/d, influenced by a $4/bbl spread between West Texas Intermediate and Brent prices.

Impact of Price Movements on Production

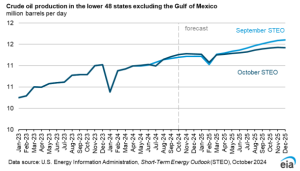

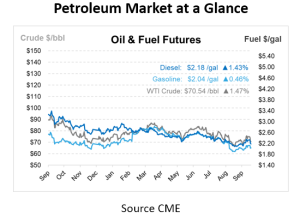

Recent low crude prices have influenced the EIA’s projections for US crude oil production. With West Texas Intermediate crude futures falling to around $65 per barrel, the agency anticipates that this price decline will begin affecting US production levels by mid-2025, as there is typically a six-month lag between price changes and production responses. As a result, the EIA now expects that US crude production in the lower 48 states will average 11.4 million b/d by December 2025, marking a 2% reduction from previous forecasts.

As energy markets navigate the complexities of geopolitical tensions and fluctuating prices, the path forward will depend on strategic production adjustments and market responsiveness. The outlook for 2025 suggests a return to increased supply, but the potential for volatility remains, underscoring the need for vigilant monitoring of both production levels and the developments in the Middle East conflicts.

This article is part of Daily Market News & Insights

Tagged: EIA Outlook, Oil production, opec

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.