Oil Prices Plummet on Revised Forecasts and Renewed Demand Concerns

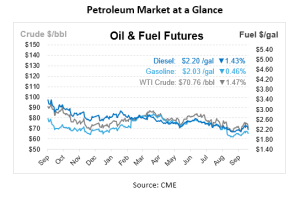

Renewed demand concerns led crude oil and refined product futures to drop sharply on Monday. Oil prices fell 2.3%, gasoline futures decreased by 2%, and diesel futures declined by 3%. The declines followed OPEC’s revised forecast, which lowered its oil demand growth expectations for 2024 and 2025. Markets were disappointed by a stimulus plan from China, and a strengthening U.S. dollar further pressured energy prices by making oil more expensive for traders using other currencies.

According to the October 2024 IEA Oil Market Report, global oil demand is expected to slow significantly, growing by just under 900,000 barrels per day (bpd) in 2024 and around 1 Mbpd in 2025, compared to the 2 Mbpd seen in the post-pandemic period. China, which was a major driver of growth in 2023, will account for only 20% of the demand increases in the next two years.

Oil supply fell by 640,000 bpd in September due to political disruptions in Libya and maintenance in Kazakhstan and Norway, but non-OPEC+ supply, particularly from the Americas, is expected to grow by 1.5 Mbpd in both 2024 and 2025, offsetting the demand increase. Refining margins and crude run estimates have declined, and global oil inventories fell by 22.3 million barrels in August, supported by strong refining activity and OPEC+ cuts.

Oil prices rose by $8 per barrel in early October, pushed by concerns over the Israel-Iran conflict, although global supply remains stable with resumed Libyan exports and substantial OPEC+ spare capacity. OPEC revised its 2024 demand growth forecast to 1.93 Mbpd and its 2025 estimate to 1.64 Mbpd, largely due to weaker Chinese demand. OPEC+ is expected to maintain output cuts until the end of 2025 to stabilize oil prices. Despite the cuts, OPEC’s forecast remains more bullish than the IEA’s, which predicts lower demand growth of 900,000 bpd in 2024.

In response to recent missile attacks from Iran, Israeli Prime Minister Benjamin Netanyahu has informed the Biden administration of plans to target Iranian military infrastructure in a potential retaliatory strike. This approach is intended to limit the escalation of conflict and avoid triggering a full-scale war, as both Israel and the U.S. seek to prevent regional destabilization.

Meanwhile, the U.S. has expanded sanctions on Iran’s petroleum and petrochemical sectors, targeting Iran’s “ghost fleet” of vessels used to transport oil illegally. The sanctions aim to cut off funds supporting Iran’s missile programs and terrorist activities. The U.S. Treasury and State Department have sanctioned a total of 16 entities, 17 vessels, and 6 additional ships for their involvement in Iran’s petroleum trade. The U.S. plans to tighten enforcement of these sanctions by increasing monitoring through satellite technology and pressuring countries like Malaysia, Singapore, and the UAE to aid in enforcement efforts. China’s role as a buyer of Iranian oil is also a focal point for future sanctions enforcement.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.