Week in Review – Crude Prices Hit Two-Year High for Weekly Gains

This week, oil prices saw a sharp increase, with Brent crude benchmarks set for a 10% weekly gain. The surge is mainly attributed to escalating geopolitical tensions in the Middle East and concerns that the situation could lead to disruptions in global oil supplies.

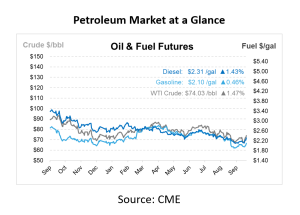

This morning, Brent prices rose by $1.09 to reach $78.71 per barrel, while WTI crude increased by $1.08, reaching $74.79 per barrel. This marks one of the largest weekly gains for crude in nearly two years.

The main factor behind the price rally is the increased risk of a broader conflict involving the US, Israel, and Iran. On Thursday, President Joe Biden stated that the US was considering supporting Israeli strikes on Iranian oil facilities following Iran’s missile attack on Israel earlier this week. Such a move could disrupt key oil flows from the region, raising concerns about supply shortages and contributing to the sharp rise in prices.

OPEC’s latest production figures show a year-to-date low output in September, reaching 26.14 million barrels per day, down from 26.54 million barrels per day in August. This decline was mainly due to a significant drop in Libyan production, which fell by 300,000 barrels per day as political disputes limited operations. Iraq also contributed to the decrease by cutting output to meet OPEC+ targets, while Nigeria experienced a smaller reduction of around 40,000 barrels per day.

However, Libya’s situation shifted positively towards the end of the week. The National Oil Corporation announced that it resolved the political dispute impacting its oilfields and export terminals, allowing Libya to more than double its output to around 1.2 million barrels per day. While this increase could help ease some supply concerns, the impact has been muted by the heightened geopolitical risks in the Middle East.

In the US, East Coast and Gulf Coast ports began reopening on Thursday night after dockworkers and port operators reached a wage agreement, ending the industry’s biggest work stoppage in nearly half a century. However, clearing the cargo backlog is expected to take time. At least 54 container ships were reported to be waiting outside the ports as of Thursday evening, with more vessels anticipated to arrive. The strike, which lasted three days, prevented the unloading of essential goods and created concerns about shortages of items ranging from bananas to automotive parts.

Additionally, Kazakhstan, another key OPEC+ member, exceeded its production quota in September by 170,000 barrels per day, reaching 1.638 million barrels per day. To offset this overproduction, Kazakhstan has pledged to cut output by 265,000 barrels per day in October and will also halt production at its Kashagan field for maintenance starting next week. These adjustments will likely balance out some of the increases expected from Libya, keeping overall OPEC+ output relatively steady.

While these production changes are influencing the broader supply picture, the main driver this week remains the potential for a wider regional conflict in the Middle East. The situation has made the market highly sensitive to any news from the region, with prices reacting swiftly to updates on military actions and political statements. Additionally, the US dollar, which reached a seven-week high following stronger-than-expected jobs data, would normally pressure oil prices downward by making crude more expensive for foreign buyers. However, the strength of geopolitical risks has outweighed this effect, sustaining the upward momentum.

The recent price surge underscores the market’s sensitivity to geopolitical developments and OPEC’s production adjustments. Although no actual supply disruptions have occurred yet, the potential for further escalation in the Middle East has created uncertainty, pushing both Brent and WTI crude to multi-week highs. Any direct impact on oil flows could drive prices even higher in the coming days as the situation continues to unfold.

Prices in Review

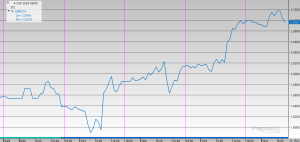

Crude prices experienced significant increases this week, primarily driven by supply constraints and market reactions to geopolitical factors. The largest gains occurred between Monday and Tuesday, as prices climbed from $63.93 to $70.11, followed by another increase on Wednesday to $72.18. Today, prices started at $74.03, marking a total gain of $10.10 per barrel, or 15.8%.

Diesel opened on Monday at $2.1279 per gallon and increased steadily, peaking midweek at $2.2487 on Wednesday. After a slight dip on Thursday, prices reached $2.3106 by Friday. This reflects a total gain of $0.1827 per gallon, or 8.6%.

Gasoline prices started at $1.9640 per gallon on Monday and remained relatively unchanged on Tuesday. However, by Wednesday, prices rose sharply to $2.0232 before stabilizing slightly on Thursday. On Friday, gasoline reached $2.1003 per gallon, resulting in a total gain of $0.1363 per gallon, or 6.9%.

This article is part of Daily Market News & Insights

Tagged: 2024, crude, crude prices, October 10, oil prices 2024, Weekly Gains

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.