Week in Review: Fuel Supply Worries Loom in Florida as Helene Shuts Down Ports and Terminals

Fuel distribution in Florida was hit hard by Hurricane Helene as it made landfall on Thursday evening. Florida, the third-largest gasoline consumer in the U.S., lacks refineries and is heavily reliant on fuel imports. With only two pipelines supplying the state, any disruption to waterborne fuel deliveries makes Florida particularly vulnerable to shortages.

Port Tampa Bay, a major hub for petroleum products, has halted vessel traffic, adding uncertainty about how long the closures will affect fuel trade. Power outages, already affecting over one million in Florida, are expected to significantly impact the state’s fuel infrastructure, with residents being advised to prepare for outages lasting up to a week. While fuel prices remain stable for now, disruptions are expected to drive them higher. Regular gasoline is currently priced at $3.176 per gallon across Florida, according to AAA.

The Bureau of Safety and Environmental Enforcement (BSEE) activated its Hurricane Response Team to monitor offshore oil and gas operations in the Gulf of Mexico as Hurricane Helene made its way through the Gulf. Offshore operators evacuated personnel from 27 production platforms. During evacuations, safety protocols are initiated to shut down oil and gas production, protecting the environment. Approximately 25.25% of current oil production in the Gulf has been shut in. Once the hurricane passes, inspections will take place, and undamaged facilities will resume production quickly, while damaged facilities may take longer to restart.

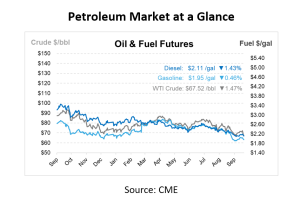

Wednesday’s Department of Energy report indicated a drop in refinery utilization, which was expected due to planned fall maintenance. This downtime typically leads to lower production and a draw on product inventories, as reflected in the data. As refinery utilization continues to decrease, crude inventories are expected to build; if this doesn’t happen, it could lead to higher prices.

The report also touches on uncertainty surrounding how mergers and acquisitions in upstream crude production will respond to a lower-price market. Currently, the market is reacting to rumors that Saudi Arabia and OPEC might increase production, though nothing has been confirmed. If OPEC+ formally adopts this strategy, it would likely put downward pressure on prices. However, any official decision is expected to be made after the upcoming elections.

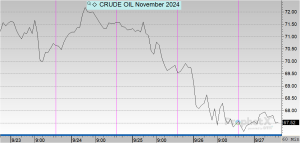

Prices in Review

Crude oil opened on Monday at $71.31, dropped off in Tuesday trading, picked up on Wednesday, and has trailed off since due to Hurricane Helene. This morning, crude opened at $67.45, a drop of $3.86 or -5.4%.

Diesel opened the week at $2.1725, fell off in Tuesday trading, and picked up slightly on Wednesday. Diesel started declining again on Thursday and opened this morning at $2.1312, an overall decrease of 4 cents or -1.9%.

Gasoline opened on Monday at $2.0465 and saw modest drops throughout the week. This morning, gasoline opened at $1.9479, a decrease of 9 cents or -4.8%.

This article is part of Daily Market News & Insights

Tagged: fuel supply, Hurricane Helene 2024

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.