Week in Review – Refined Product Prices Fluctuate on Federal Rate Cuts and Geopolitical Tensions

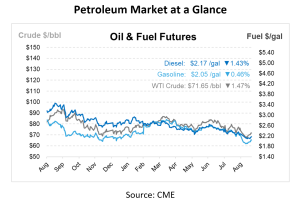

This week, crude oil and refined product futures saw gradual gains, fueled by the Federal Reserve’s recent interest rate cut and its potential to stimulate the global economy and energy demand. On Thursday, the NYMEX November WTI crude contract rose by $1.28, closing at $71.16/bbl, while the October contract gained $1.04 to settle at $71.95. Refined products followed suit, with the November ULSD contract up 2.36 cents to $2.1824/gal, and the October ULSD contract increasing by 2.45 cents to $2.172.

Despite these gains, crude futures fell by $0.30 /bbl this morning as the October 2024 contract approached expiration. This slight dip comes after Thursday’s price increase, driven by U.S. equity rallies and heightened tensions in the Middle East. The S&P and DOW both closed at record highs yesterday, bolstered by the Federal Reserve’s decision to cut interest rates by 50 basis points, bringing them to a range of 4.75% to 5%—the first such cut since 2020. Analysts anticipate further rate reductions in the coming months, with Goldman Sachs predicting additional quarter-percentage-point cuts through mid-2024. As of this morning, U.S. equity futures are down, and the dollar has strengthened.

Next week, the market will be closely watching OPEC+, as the group is set to release its 2024 World Oil Outlook at a conference in Rio de Janeiro. This follows OPEC’s decision to lower global oil growth forecasts. Meanwhile, Russia has continued to defy Western sanctions, increasing its use of blacklisted oil tankers to deliver crude directly to China and India.

In the U.S., crude refiners are planning fewer maintenance shutdowns this fall, with only 529,000 barrels of refining capacity expected to be taken offline, compared to 1.04 million barrels last year and 750,000 barrels in 2022.

On the demand side, J.P. Morgan analysts reported that global oil demand averaged 102.5 million barrels per day (Mbpd) through September 18, a 200,000 barrel-per-day increase compared to the same period last year, but 600,000 barrels short of their forecasts. Despite an 800,000 barrel-per-day improvement from the previous week, demand remains below projections. Year-to-date demand growth stands at 1.1 Mbpd, falling short of the 1.5 Mbpd increase projected earlier. Typhoon disruptions in China and flooding in Europe and Africa have also dampened global demand.

Global oil inventories were flat in the second week of September, following a 32 million barrel build the previous week. Crude stocks dropped by 5 million barrels, while oil product inventories increased by 5 million barrels, driven mainly by U.S. market activity. Earlier in the month, global oil demand averaged 102.2 Mbpd, falling short of J.P. Morgan’s estimates due to ongoing typhoon and hurricane disruptions.

August saw global demand reach 104.5 Mbpd, surpassing last year’s levels by 1.2 Mbpd. However, geopolitical tensions remain a key concern. In the Middle East, Hezbollah leader Hassan Nasrallah vowed retaliation against Israel following the deaths of his fighters, further unsettling the region.

Prices In Review

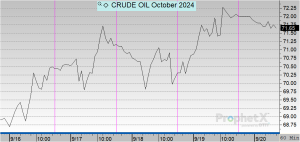

Crude opened on Monday at $69.16 and saw marginal increases throughout the week. This morning, crude opened at $72.10, an overall increase of $2.94 or 4.25%.

Diesel opened the week at $2.0856 and also saw marginal increases throughout the week. This morning, diesel opened at $2.17949.

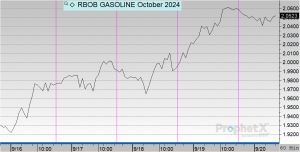

Gasoline opened on Monday at $1.9396 and increased slightly each day this week. This morning, gasoline opened at $2.0607, an increase of 12 cents or 6.24%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.