Should Your Company Move Towards Green Fleets? 2024 Update

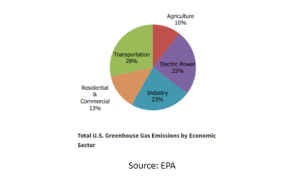

Do you remember what you were doing seven years ago? Here at Mansfield, we were already focused on sustainability. Back In 2017, we published “Should Your Company Move Towards Green Fleets?, exploring the growing trend of fleet companies adopting greener and more sustainable practices. With the transportation industry accounting for 26% of US greenhouse gas emissions at the time, businesses were starting to face the reality of their environmental impact and the pressure for change.

Companies like Walmart, UPS, and FedEx were already making progresses toward adopting green fleets to enhance their sustainability profiles and brand image. However, the trucking and transportation industries recognized that simply improving their public image wasn’t enough—actual changes were necessary to meet tightening regulations and rising consumer demand for eco-friendly practices. Fast forward to 2024, here’s what’s changed:

Cleaner Fuel Alternatives

A significant step in reducing fleet’s emissions is transitioning to sustainable fuels. Traditional gasoline and diesel-powered vehicles are notorious for their contributions to greenhouse gas emissions. According to the United States Environmental Protection Agency (EPA), in 2022, the transportation industry was still responsible for 28% Greenhouse Gas Emissions.

Shifting to cleaner alternatives, such as biofuels—including ethanol, biodiesel, and renewable diesel—can significantly lower emissions. Each of these options has its advantages and can significantly lower emissions. You can learn more about biofuels here.

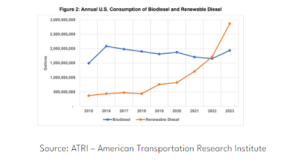

Renewable diesel, which was already being explored in 2017, has become a more viable solution due to expanded production capabilities and more geographic availability. Unlike biodiesel – that often requires blending with petroleum diesel to meet engine manufacturers’ specifications and avoid cold weather performance issues -, renewable diesel provides a drop-in alternative with no modifications to existing diesel engines. Supply and distribution channels are now more developed and, while cost challenges still exist in non-incentivized markets, the increased availability and growing Low Carbon Fuel Standard (LCFS) program have made renewable diesel more competitive versus conventional fossil diesel. You can learn more about LCFS here.

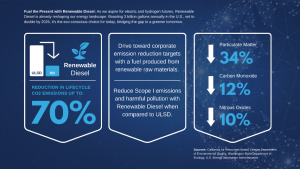

The use of Renewable Diesel reduces lifecycle CO2 emissions by up to 70% while also reducing harmful pollutants – approximately 34% in particulate matter, 12% in carbon monoxide, and 10% in nitrogen oxides. Because renewable diesel emits biogenic carbon, it also minimizes Scope emissions.

Electric Vehicles (EVs)

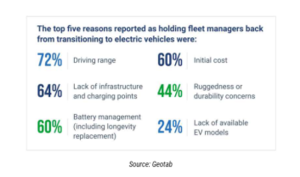

In 2017, the cost of electric vehicles and the lack of charging infrastructure were significant barriers to adoption. Today, with advances in battery technology and government investment in EV infrastructure, are making EVs more accessible. However, fleet electrification is still facing operational and cost-related headwinds.

While genuine benefits exist, several often-overlooked costs are still associated with this shift. For instance, electric trucks tend to be pricier, even with subsidies, have shorter road ranges and less off-road capability, and demand major infrastructure adjustments. Plus, the return on investment remains uncertain.

Acquisition costs for EVs vary significantly across vehicle classes, with medium- and heavy-duty trucks being the most expensive. Additionally, ongoing maintenance costs for charging stations, mechanic training expenses, and the need for specialized equipment further strain budgets. Even collision repair costs for EVs are significantly higher than those for traditional vehicles, with insurance companies more inclined to declare EVs as total losses due to battery damage. For more insights on this topic, check out our article “Is Fleet Electrification Over Your Budget? Renewable Fuels Could Be Your Answer” .

Compressed Natural Gas (CNG)

CNG, once considered the biggest disruptor in the transportation sector, saw a dip in demand when oil prices plummeted post-2015. However, with a renewed focus on reducing methane emissions (a critical component of natural gas), CNG is being refined to serve as a lower-carbon alternative. CNG is no longer seen solely as a way to cut costs but as a bridge fuel that helps transition fleets toward zero-emission goals.

Carbon Credits

Carbon credits involve investing in projects that mitigate carbon emissions, such as reforestation, methane capture, or renewable energy projects. In 2017, they were an often-overlooked option, as the return on investment would come from “soft” metrics like brand reputation, recruitment, and meeting RFP criteria, rather than measurable savings from fuel or maintenance, making the ROI harder to quantify.

Today, carbon credits are more cost-effective and measurable, thanks to advancements in carbon accounting and tracking systems. However, they are often viewed as a last-measure solution, with the expectation that companies first avoid, second reduce, and lastly compensate carbon emissions.

What Remains a Challenge?

The green fleet movement has undeniably gained force. What began as an ambition to clean up the transportation industry in the 2010s has transformed into a full-real movement. However, the road to sustainability is still under construction. The real question fleet operators face today is not if they should go green, but how they can make the transition without significant budgetary impact and how to remain compliant with current and upcoming legislation.

Going greener with Mansfield

As the demand for sustainable fuel solutions grows, renewable fuels stand out as an easy-to-implement choice that does not compromise on performance. For fleet operators looking to make a change, the path forward is clear and promising.

Mansfield’s team of experts is at the forefront of this revolution, ready to help fleet operators understand and harness the benefits of switching to renewable fuels. Contact us today!

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.