Week in Review: Crude Stockpiles Dive, OPEC+ Pauses Supply, but Prices Still Slide

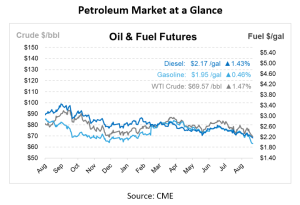

Prompt crude futures are up by $0.42/bbl today, though both WTI and Brent are set to close the week down by approximately $4 and $4.50/bbl, respectively. Crude prices rallied some on Thursday after a reported 6.9 million barrel U.S. crude inventory draw and OPEC+’s decision to pause oil supply increases. OPEC+ has delayed its planned 180,000 bpd supply increase for October, with increases now set to resume in December 2024 and complete by November 2025. This decision followed falling oil prices due to weak Chinese and U.S. economic data. Kazakhstan also confirmed production cuts of 265,000 bpd in October to compensate for earlier overproduction.

As summer winds down, the high-demand driving season has practically gone, even though gasoline demand typically shows late summer strength. The Energy Information Administration (EIA) noted that last week’s gasoline consumption was closer to mid-October levels than late August. For the third time in the last eight years, U.S. gasoline stocks increased by 800,000 barrels, which is rare for this time of year. Compared to the same weeks in 2022 and 2023, the Gulf Coast faces a 2.5–7.5 million barrel shortfall, showing the importance of building stocks.

The demand for gasoline fell short of last year’s levels by 369,000 bpd to 8.938 Mbpd. Even yet, gasoline production increased to about 9.9 Mbpd, countering a 212,000 barrel drop in imports. While exports hit a three-week high of 865,000 bpd, gasoline imports to the East and Gulf Coasts decreased.

Crude runs increased by 36,000 bpd to 16.9 Mbpd, surpassing levels from 2022 and 2023, while refinery runs were steady. The second-highest distillate output rate of the year, 5.169 Mbpd, was achieved, although stockpiles decreased by 400,000 barrels, mainly as a result of a draw in the Gulf Coast. Still, distillate stockpiles on the East Coast rose by 800,000 barrels.

With a 6.9 million barrel reduction, crude oil stockpiles dropped further, reaching 418.3 million barrels. In the event that draws go on, stocks may drop below 400 million barrels, a level not seen since 2018. Due in part to a drop in imports, the Gulf Coast led the draw with a 5.8 million barrel reduction. At 1.8 million barrels, the Strategic Petroleum Reserve had an exceptionally high build. In terms of historical averages, U.S. crude oil inventories are 5% below the five-year average, gasoline inventories are 2% below, and distillate inventories are 10% below the five-year average for this time of year.

Prices in Review

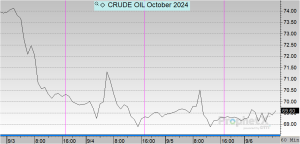

On Tuesday, crude opened the week at $73.53 before dropping $3/bbl on Wednesday and another dollar on Thursday. This morning, crude opened at $69.33, an overall decrease of $4.20 or -5.7%.

Diesel opened the week at $2.2806 and trailed off during Wednesday and Thursday sessions. This morning, diesel opened at $2.1711, a decrease of almost 11 cents or -4.8%.

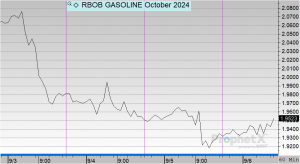

Gasoline opened on Tuesday at $2.0936 and tapered off for the remainder of the week. This morning, gasoline opened at $1.9362, a decrease of 15 cents or -7.5%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.