China’s Drag on Oil Prices: Is the Real Story Inflation Adjustment?

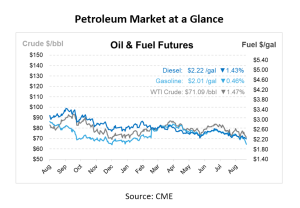

Oil prices are down by over $1/bbl this morning due to growing concerns about weak economic growth in China, the largest crude importer, which overshadowed the impact of ceased production and exports from Libya. The weaker-than-expected Chinese manufacturing PMI exacerbated concerns about the Chinese economy’s performance, adding to the demand worries. Despite the disruptions in Libya, where oil exports were discontinued and production sharply reduced, the impact on prices have been limited due to uncertainty about the duration of these outages.

Although some supply is expected to return as OPEC+ members plan to increase output in October, continued supply disruptions in the Middle East, including attacks on oil tankers in the Red Sea, are putting upward pressure on the market. Analysts suggest that OPEC+ may react if prices fall too low, as most members need higher prices to balance their budgets.

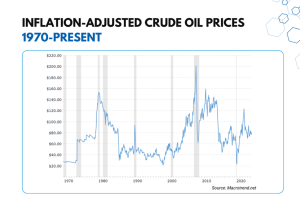

When comparing oil prices over the years, it can seem extreme to see a rise from $60/bbl or below to almost $100/bbl, which is what we have seen over the past few years. However, if adjusted for inflation, the situation appears less extreme. While the March 2022 price of oil reached $124/bbl and was considered high at $108, adjusting for inflation puts these numbers in a different perspective. For example, the seemingly low $38 price from 1980, when adjusted for 42 years of inflation, equates to around $140 in today’s dollars. This comparison shows that the current price of $71/bbl is not as high as it may seem when viewed historically.

Inflation-adjusted charts reveal that oil price trends can be long-lasting and highly volatile. Although there has been recent downward pressure on oil prices, continued inflation and global supply-demand issues might reverse the pattern. It’s important to adjust for inflation to gain a clearer understanding of these trends, as nominal prices alone can be misleading. Without considering the impact of inflation, comparisons over time can misrepresent the real value of prices, leading to incorrect conclusions about investment trends and economic conditions.

In light of increased competition from the newly constructed Trans Mountain pipeline (TMX), pipelines that have historically been used to send Canadian petroleum to the United States are lowering their prices and shifting to move alternative types of crude. This change will temporarily reduce the cost of shipping heavy oil from Canada to the Midwest and Gulf Coast of the United States.

In May, the TMX started exporting up to 890,000 bpd to the Pacific Coast of Canada, using 80% of its contractual capacity and 20% for ad hoc shipments. Enbridge, a significant Canadian pipeline operator, announced an 11% tariff cut for September on its Mainline system, which carries the majority of Canada’s petroleum exports to the United States, in response to additional oil being diverted to TMX.

This article is part of Daily Market News & Insights

Tagged: China, Inflation, oil prices

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.