Week in Review: OPEC+ Steady on October Output Hike Despite Market Uncertainty

Ahead of the OPEC meeting this weekend, crude futures are trading lower but on track for a weekly gain. Yesterday, gasoline futures jumped back up from a seven-month low. Diesel futures also saw a jump, with the October NYMEX ULSD rising by over 5 cents and RBOB gaining by over 4 cents. These gains put oil contracts on track for weekly increases, with WTI prices up about 1.4% from the previous week. Refined product futures remained about 1.6% below their levels from a week earlier. The ongoing political unrest in Libya, which has led to hefty reductions in the country’s oil production, contributed to the price volatility. Rising oil prices are adding pressure on refiners facing shrinking margins and may reduce refinery runs to bolster refined product prices.

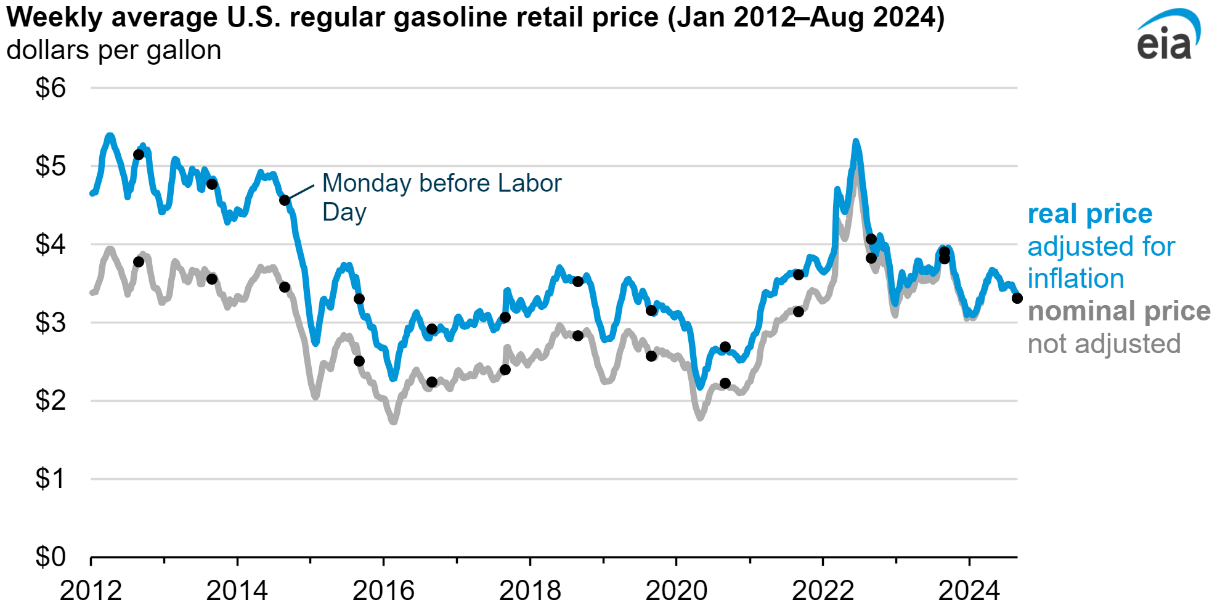

As of August 26, 2024, U.S. gasoline prices averaged $3.31/gal, 13% lower than the same time last year, primarily due to weak global demand and increased crude oil production outside of OPEC+. Despite an OPEC+ decision to extend production cuts, crude oil prices have decreased, with Brent crude down 4%. U.S. gasoline inventories have risen by 3%, and although demand is up heading into Labor Day, it remains lower than in 2023.

Regional prices show the greatest decrease on the West Coast, where prices dropped by $0.83/gal (17%) to $4.05/gal. Other regions saw smaller declines, with the Gulf Coast having the lowest average at $2.89/gal. Weather events, such as storm-related refinery outages, caused slight regional price fluctuations but had no significant impact on overall refinery activity or demand.

OPEC+ plans to proceed with an oil output increase in October despite concerns over sluggish demand, particularly from China. Eight OPEC+ members are set to boost production by 180,000 bpd as part of a strategy to gradually unwind a recent 2.2 million bpd output cut while maintaining other cuts until the end of 2025.

The decision comes as Libyan production outages tighten the market, and there is optimism that a potential U.S. Federal Reserve interest rate cut in mid-September could stimulate economic growth. However, OPEC+ remains cautious, with Saudi Arabia’s Energy Minister noting that the group could pause or reverse the production increase if the market conditions weaken. Formal discussions within OPEC+ are not scheduled until the Joint Ministerial Monitoring Committee meeting on October 2, which could lead to recommendations for the broader group.

Prices in Review

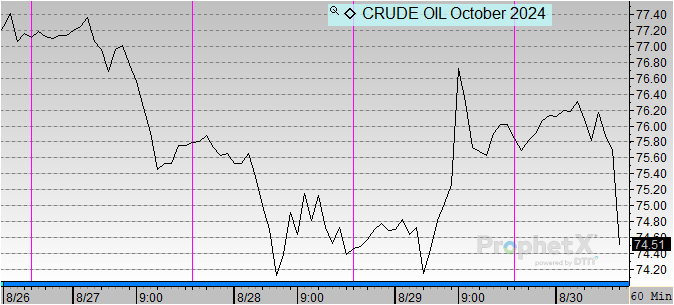

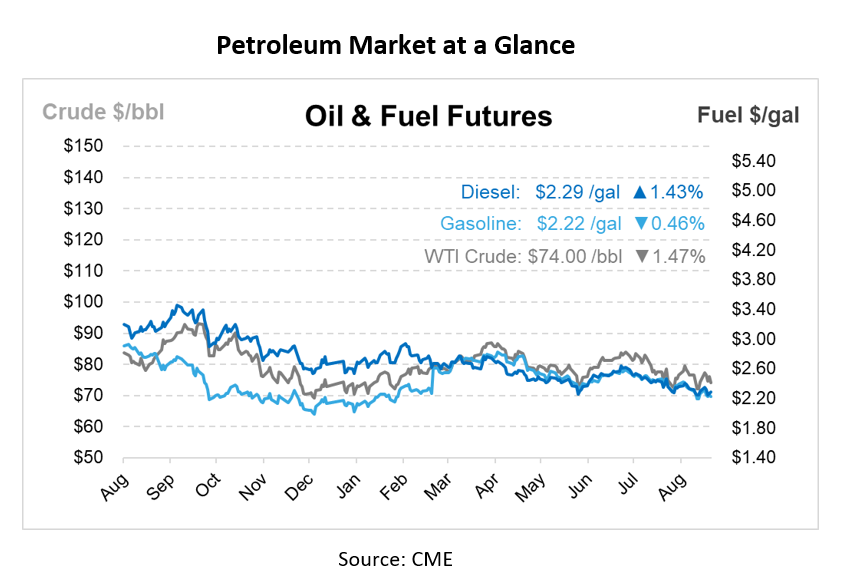

Crude opened the week at $75.10 before jumping up on Tuesday and teetering off Wednesday and Thursday. This morning, crude opened at $75.87, an overall increase of 7 cents or 1.025%.

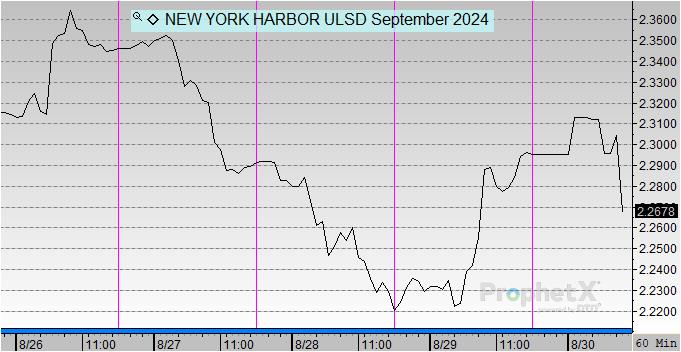

Diesel opened on Monday at $2.3141 and increased on Tuesday before dipping back off on Wednesday. This morning, diesel opened at $2.2952, a decrease of almost 2 cents or -0.8%.

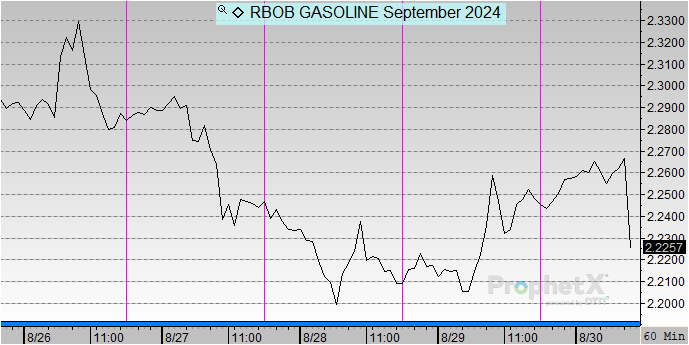

On Monday, gasoline opened at $2.2984, and saw steady decreases throughout the week. This morning, gasoline opened at $2.245, an overall decrease of 5 cents or -2.32%.

This article is part of Daily Market News & Insights

Tagged: crude, crude prices, Daily Market News & Insights, demand, diesel, eia, fuel prices, gasoline, Inventories, opec, prices, Saudi Arabia, Supply, wti crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.