New Financing Initiative to Release Billions for Methane Leak Prevention

As the oil and gas industry faces increasing pressure to reduce its environmental impact, a new global initiative is set to provide critical support in the form of transition financing specifically aimed at methane emission reductions. This initiative, driven by a coalition of around 50 organizations including the Climate Bonds Initiative (CBI) and the International Energy Agency (IEA), is developing guidelines that could unlock billions of dollars in funding for oil and gas producers committed to cutting methane emissions.

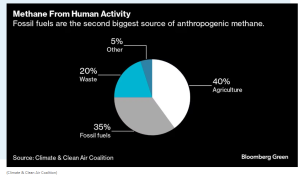

Historically, methane emissions from fossil fuels have received only a fraction of the global climate financing, with less than 1% of the $13.7 billion annual average directed toward methane mitigation in recent years. The new initiative aims to change this by providing a clear pathway for oil and gas producers to access the necessary funds to implement methane reduction projects. This is particularly important as the sector accounts for about 35% of methane emissions generated from human activity.

Guidelines Aligned with Net Zero Goals

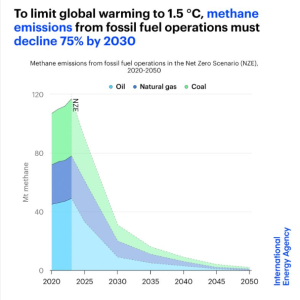

The guidelines being developed will be consistent with the IEA’s Net Zero by 2050 roadmap, which outlines the steps needed to limit global temperature rise to 1.5°C. This means that investments will be focused on projects that contribute to significant methane emission reductions in line with these global climate targets. For example, while new gas field developments in regions like the Gulf of Mexico may not qualify for this financing, projects aimed at eliminating flaring in countries such as Turkmenistan will.

The coalition plans to present its funding recommendations at the COP29 UN climate conference in November, along with two demonstration deals to showcase the potential impact of these financing mechanisms. This event will be a critical moment for the oil and gas industry to understand the opportunities and requirements associated with accessing transition financing for methane mitigation.

Expansion of Transition Bonds

Transition bonds have rapidly become a vital part of the sustainable debt market, with issuance reaching nearly $20 billion this year alone. These bonds, typically issued by fossil fuel companies to fund emission-abatement efforts, will likely be influenced by the new guidelines, ensuring they align with global methane reduction targets. Additionally, there is discussion around the potential for incentive-linked financing, where bond contracts could include specific emissions reduction targets that adjust interest rates based on whether the commitments are met. This approach could ensure that companies not only commit to but also achieve their methane reduction goals.

State-owned oil and gas producers, which produce over half of the world’s oil and gas and are responsible for a significant share of methane emissions, will be central to these efforts. Many of these have already pledged to reduce methane intensity, but substantial investments will be needed to meet these commitments.

The IEA estimates that achieving a 75% reduction in methane emissions from fossil fuels by 2030 will require an investment of $170 billion, with $45 billion needed in low- and middle-income countries. This highlights the urgency for industry players to secure transition financing and start implementing methane reduction projects as soon as possible.

The availability of transition financing will depend on producers’ ability to meet the new criteria and guidelines. Those that are proactive in aligning their operations with these standards will not only contribute to global climate goals but also position themselves favorably in an evolving financial landscape.

Focusing on a sustainable future is essential, but it is equally important to ensure that all efforts remain compliant with current legislation. Balancing innovation with adherence to legal frameworks allows for the development of solutions that are both environmentally responsible and legally sound. By integrating sustainability goals with regulatory requirements, we can create a future that is not only greener but also aligned with the law, ensuring long-term success and stability.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.