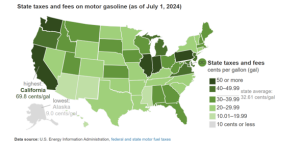

State Fuel Taxes Adjustments Across the US

State Fuel taxes and fees on gasoline and diesel fuel have settled at an average of $0.33 per gallon for gasoline and $0.35 per gallon for diesel, according to data from the U.S. Energy Information Administration (EIA). While the beginning of the year saw only slight increases—each under half a cent—this seemingly stable national average conceals significant shifts in fuel tax rates across various states. These changes underscore the diverse strategies states employ in managing fuel taxation, with some regions experiencing notable increases or decreases.

Despite the near-flat national averages, some states saw noticeable adjustments to their fuel tax rates. Gasoline taxes decreased in three states, with Kentucky experiencing the largest drop of $0.023, bringing its gasoline tax rate down to $0.2780/gal. Conversely, nine states increased their gasoline taxes, with Indiana leading the pack with a $0.044 hike, raising its rate to $0.5610/gal.

Diesel fuel taxes followed a similar pattern, with decreases in four states and increases in eight. California, known for its high fuel taxes, implemented the most significant decrease in diesel tax rates, lowering it by $0.0420. On the other hand, Colorado saw the largest increase in diesel taxes, with a $0.0263 rise, bringing its rate to $0.3068/gal.

Federal Tax Rates and Consistency

While state taxes experienced fluctuations, federal tax rates have remained consistent. The federal government continues to impose a tax of $0.1840/gal on gasoline and $0.2440/gal on diesel, which includes an additional $0.001/gal from the Leaking Underground Storage Tank Fund. This consistency at the federal level provides a stable baseline, though state-level changes can significantly impact overall fuel costs for consumers.

The Extremes: Highest and Lowest Tax Rates

The disparity in fuel tax rates across states remains stark. Alaska, Mississippi, and Hawaii continue to have the lowest fuel taxes, with both gasoline and diesel taxes in these states hovering around $0.0895/gal in Alaska and just over $0.18/gal in Mississippi and Hawaii.

In contrast, California, Illinois, and Pennsylvania maintain the highest fuel taxes in the country. California’s gasoline tax stands at a whopping $0.6982/gal, while its diesel tax reaches $0.9212/gal, reflecting the state’s ongoing efforts to fund transportation infrastructure and environmental initiatives. Illinois and Pennsylvania follow closely behind, with both states imposing taxes over $0.67/gal for gasoline and above $0.74/gal for diesel.

The semiannual update of federal and state motor fuel taxes provides a critical snapshot of the shifting landscape of fuel costs across the United States. While the national average tax rates have seen only minor adjustments, the variations among states highlight the ongoing complexity of fuel taxation in the US. These changes have significant implications for consumers, particularly those in states with the most significant tax hikes or reductions.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.