What’s That: Very Large Crude Carriers – VLCC

Have you ever wondered how large amounts of crude oil are imported and exported? In today’s article of What’s That Wednesday, we will learn all about Very Large Crude Carriers (VLCC) and how they are vital to the energy sector. Very Large Crude Carriers are ginormous cargo vessels and can be a minimum size of 250,000 deadweight tonnage. Let’s dive into all the functions of VLCC’s and see how they make an impact in the transportation of crude oil.

Background of Very Large Crude Carriers

You might wonder why these vessels are called ‘Very Large Crude Carriers.’ The Shell Oil Company first created the weighing system that later developed the terminology ‘Very Large Crude Carriers’. According to the Average Freight Rate Assessment (AFRA), the classifications of oil tankers are based on deadweight tonnage (DWT). Deadweight tonnage measures the weight capacity of crude oil vessels. AFRA’s method became successful in specifying tankers and their individual cargo-carrying capacity. Very Large Crude Carriers are also known as ‘supertankers’ due to their colossal weight-carrying capacity. VLCCs were created for the important purpose of importing and exporting extremely large loads of crude oil.

How Do They Function?

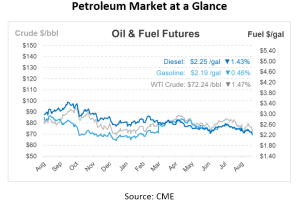

The London Tanker Brokers’ Panel is an independent group of shipping brokers that oversee the Average Freight Rate Assessment (AFRA) of vessels. The AFRA is a standard classification system for vessels to determine contract terms and conditions, and shipping costs. As we learned previously, tanker vessels are classified by deadweight tons measured on the AFRA scale. This approximates a ship’s cargo capacity at about 90% of its deadweight tonnage, multiplied by barrels per metric ton. VLCCs are responsible for most of the global crude oil shipments, including those from the North Sea, home to the crude oil price benchmark Brent. VLCCs can carry some of the heaviest loads of crude oil compared to other vessels, typically between 1.9 million and 2.2 million barrels of West Texas Intermediate (WTI) crude oil. With current WTI prices at $72 per barrel , a Very Large Crude Carrier can transport around $100 million worth of crude oil at a time.

VLCC’s and Their Relationship to Crude Prices

Crude oil prices are highly sensitive to disruptions in the supply chain, and interruptions involving (VLCCs) can significantly influence market dynamics. VLCCs, with their vast capacity, transport crude oil from major production regions, such as the Middle East, to global markets. Any disruption in their routes due to geopolitical tensions or harsh weather conditions can create immediate ripples in the oil markets.

Geopolitical tensions in key marine checkpoints like the Strait of Hormuz, the Suez Canal, and the Bab el-Mandeb Strait can have profound implications. These locations are critical for the smooth passage of VLCCs carrying millions of barrels of oil daily. For instance, if political instability or military conflicts threaten the safety of these routes, VLCCs may face delays or rerouting, which can lead to a sudden decrease in the supply of crude oil to the market. Such disruptions often cause oil prices spikes as traders anticipate shortages and increased transportation costs. The mere threat of a blockade or attacks on tankers can lead to heightened market volatility and speculative trading, further driving up prices.

Harsh weather conditions also threaten VLCC operations. Hurricanes, typhoons, and severe storms can impede the movement of these massive vessels, particularly in regions prone to such weather events like the Gulf of Mexico or the South China Sea. Delays caused by adverse weather can lead to bottlenecks in supply, disrupting the timely delivery of crude oil to refineries and markets.

How Do VLCCs Impact the Energy Economy?

VLCCs Crude oil stands as the world’s most crucial and valuable commodity, capable of triggering ripple effects across the global economy. Very Large Crude Carriers in the tanker business often operate under contracts lasting several months to a few years. As one of the largest tanker vessels for crude oil, VLCCs play a key role in the global import and export of crude oil. Their freight routes create a varied pattern across their sailing paths. A 2019 report by The Maritime Executive provided data demonstrating diverse sailing patterns for VLCCs among different countries.

In the western hemisphere, VLCC patterns were sparse and scattered across African, European, and American countries compared to the eastern hemisphere. Gulf countries like Singapore and Northeast Asia serve as pivotal points for both the selling and purchasing of VLCC tanker voyages. In 2019, the Global Trade Routes of Very Large Crude Carriers made around 2,964 international calls linking 206 ports in 62 countries.

The United States has just one port equipped to handle VLCCs: the Louisiana Offshore Oil Port (LOOP). LOOP manages all crude oil transactions via VLCC vessels in the United States, making the Louisiana Offshore Oil Port a highly valuable asset in the U.S. crude oil industry. Very large crude carriers play an integral role in the global exchange of crude oil, impacting not just the United States but the entire world.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.