Crude and Heating Oil Trend Lower in the Middle of Global Demand Slowdown

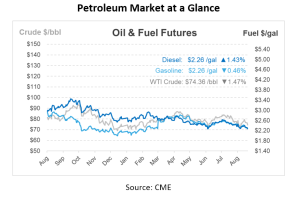

Crude oil futures are trending lower, largely due to weak demand from China and geopolitical developments, including recent ceasefire talks between Israel and Hamas. Additionally, U.S. crude oil inventories showed an unexpected increase, which could put further pressure on prices if this trend continues.

Yesterday, prompt crude prices fell by over $2/bbl, and both Brent and WTI benchmarks are down for a third consecutive day with Brent down over 2% and WTI easing off by 3%. Prices are down alongside the announcement yesterday by U.S. Secretary of State Antony Blinken that the Israeli Prime Minister had accepted a cease-fire proposal to end the conflict in Gaza. The next step is for Hamas to agree to the proposal. Equities rose yesterday, unlike crude benchmarks, with the S&P 500 gaining nearly 1%. This marks eight consecutive days of gains, the longest streak since November, ahead of this week’s economic symposium.

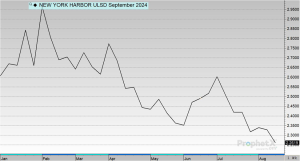

Prompt heating oil futures are also down and at their lowest point of the calendar year. The NYMEX ULSD is currently sitting at around $2.26/bbl and has been continuing to decline since early July. This is the lowest point since May of 2023.

A Bank of America Global Research report warns of a soft oil supply/demand backdrop, noting that non-OPEC+ output is expected to increase by about 1 Mbpd in 2024 and 1.6 Mbpd in 2025, driven by production in Brazil, Guyana, Canada, and the U.S. While OPEC+ may add barrels in the latter half of the year, global oil demand growth is slowing, leading to a projected 700,000 bpd surplus in 2025. Brent crude oil prices are forecasted to average $86/bbl in 2024 and $80/bbl in 2025.

Standard Chartered Bank highlighted discrepancies in 2024 global oil demand growth forecasts, ranging from the IEA’s 970,000 bpd to OPEC’s 2.112 Mbpd. The bank noted that demand growth has averaged 1.1 Mbpd over the past 20 years, with some forecasts exceeding this average.

Mergers and acquisitions in the oil and gas industry jumped by 57% in 2023, with top energy companies spending $49.2 billion on mergers and acquisitions, up from $31.4 billion in 2022, according to an Ernst & Young report. This increase was primarily driven by mega deals among integrated oil and gas companies. After years of prioritizing shareholder returns, exploration and development spending also rose by 28% to $93.1 billion, marking a strategic shift towards growth and consolidation.

In 2023, oil and gas companies reduced spending on dividends and share repurchases, cutting these payments to $28.9 billion from $57.7 billion in 2022. Overall, sector expenditures increased by 36% to $142.3 billion. Despite this, profits dropped by 55% to $83.9 billion, largely due to lower WTI crude oil prices.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.