Week in Review: Oil Markets Juggle Rising Prices, Geopolitical Risks, and Demand Uncertainty

Crude oil futures are up around 30c/bbl this morning, carrying over from yesterday’s gains which set themselves up for a week-ending gain of more than 3% or $2.50/bbl. The rebound in prices comes after previous declines during the week caused by the Middle East’s mounting geopolitical tensions, especially worries over possible Iranian retaliation against Israel and a potential impact on Iranian oil supply. On August 15, new cease-fire negotiations have been called for by the US, Qatar, and Egypt.

On Thursday, energy futures saw a boost from newfound economic confidence following the Labor Department’s announcement that 233,000 people filed first-time unemployment claims, which was fewer than economists had predicted. As the U.S. Federal Reserve postpones planned interest rate reduction, this allayed fears about a possible recession.

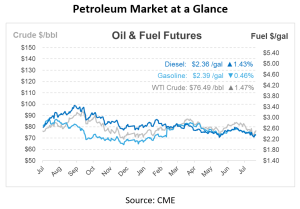

The U.S. Energy Information Administration (EIA) has lowered its Brent oil price forecast for 2024 and 2025 in its latest short-term energy outlook. The revised forecast predicts an average Brent spot price of $84.44/bbl in 2024 and $85.71/bbl in 2025, down from previous estimates of $86.37 and $88.38, respectively. Despite higher prices in July, the EIA noted recent declines due to concerns about global economic conditions. Yet, OPEC+ production cuts are expected to reduce global oil inventories, potentially pushing prices higher in the near term. Other analysts have varied predictions, with some forecasting prices as high as $109/bbl in 2025.

The STEO also notes that global liquid fuel consumption is expected to grow by 1.1 Mbpd in 2024 and 1.6 Mbpd in 2025, down from previous forecasts. The reduction is primarily attributed to slower economic growth in China, which led to decreased diesel consumption. Jet fuel demand is rising with increased air travel, with U.S. jet fuel consumption forecasted to grow by 3% in both 2024 and 2025. By 2025, U.S. jet fuel consumption is expected to surpass pre-pandemic levels, potentially causing jet fuel prices to rise more than other fuel prices.

To absorb the anticipated rise in oil production by OPEC+ beginning in October, there has to be a major increase in global oil demand growth in the upcoming months. Major consumers, such as the United States and China, have not met demand projections, which raises questions about the market’s capacity to absorb more supply, particularly in light of recession fears in the United States. Oil demand growth may slow if the economy continues to weaken, which would compel OPEC+ to postpone its intended output rise or negotiate for lower prices. According to analysts, OPEC+ may postpone its output increase due to the present economic situation. The scenario is made worse by China’s decreased petroleum imports and decreasing diesel consumption, as well as the slowing demand in the United States that is unlikely to match official projections. Whether the worldwide demand will balance the increased supply this year is still up in the air.

Prices in Review

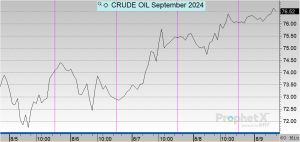

Crude opened on Monday at $74.21 before dropping slightly on Tuesday and Wednesday. Crude shot back up on Thursday morning and opened today at $76.02, an increase of $1.81 or 2.44%.

On Monday, diesel opened at $2.3307 and saw dips on Tuesday and Wednesday. This morning, diesel opened at $2.3592, an increase of 2 cents or 1.22%.

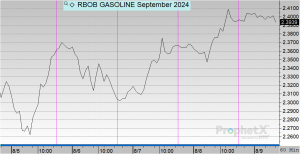

Gasoline opened the week at $2.3297 before increasing on Tuesday, dipping off on Wednesday, and picking back up on Thursday. This morning, gasoline opened at $2.3939, an increase of nearly 7 cents or 2.75%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.