Canada’s Oil Exports to the U.S. Hit New Heights

The integration of Canadian crude oil into U.S. refineries has surged over the past decade. According to the U.S. Energy Information Administration (EIA), by January 2024, the United States had an impressive oil refining capacity of 18.4 million barrels per day (b/d), with Canadian crude playing an important role. This transformation underscores Canada’s growing significance in the U.S. energy supply chain, driven by robust production and strategic infrastructural advancements.

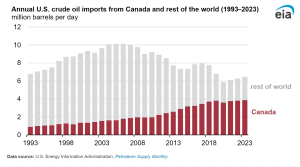

Between 2013 and 2023, Canadian crude oil imports to the U.S. grew by an average of 4% annually. By 2023, Canadian crude oil accounted for 24% of U.S. refinery throughput, up from 17% in 2013. This growth is supported by Canada’s average crude oil production of 4.6 million b/d in 2023, nearly three times its 1.7 million b/d refinery capacity.

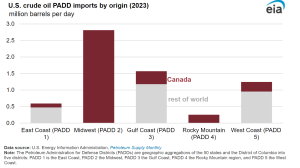

Many U.S. refineries are specifically designed to handle the heavy oils produced from Canada’s oil sands. These refineries convert heavy crude into valuable refined products like gasoline, diesel, chemicals, and plastics. The geographic proximity of Canada to the United States facilitates the transportation of crude oil from Alberta’s production regions to U.S. refineries, primarily via pipeline networks. This is particularly evident in inland regions such as the Midwest (PADD 2) and Rocky Mountains (PADD 4), closely connected to Canadian oil markets.

In recent years, there has been a notable increase in pipeline capacity to transport Canadian crude oil to the United States. The Express Pipeline, for example, expanded its capacity from 287,000 b/d to 310,000 b/d in 2020, boosting oil sands exports from Western Canada to U.S. Rockies region refineries. In May 2024, the Trans Mountain Expansion Project (TMX) became operational, nearly tripling the pipeline capacity to Canada’s Pacific Coast to 890,000 b/d. This project aims to alleviate bottlenecks, increase access to global markets, and drive higher oil production in Canada.

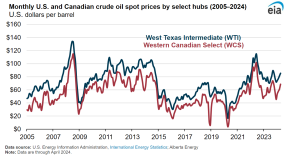

Western Canadian Select crude oil (WCS) typically trades at a discount compared to the U.S. benchmark West Texas Intermediate (WTI). This price difference is largely due to WCS being a heavier blend, requiring more advanced refining processes and higher operating costs. Consequently, U.S. refineries need to invest more in processing equipment to make WCS usable, which reduces its market value.

Despite increased production, Canada’s crude oil pipeline capacity to markets outside the country has not kept pace. This has led to the price of WCS remaining significantly lower than WTI. To overcome this, Canadian producers have resorted to rail transportation—a more costly option compared to pipelines—to deliver crude oil to the United States. This method requires larger price discounts for U.S. refiners to process WCS economically. Additionally, limited pipeline infrastructure to coastal ports has restricted Western Canada’s access to global markets, resulting in oversupply and lower local market prices for WCS.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.