Week in Review: Strong Dollar and Refinery Downtimes Impact Oil and Gas

Following better-than-expected reports on the labor market and manufacturing in the United States earlier in the week, the U.S. dollar index increased for the second straight day. A stronger dollar reduces demand from consumers holding foreign currencies for oil priced in dollars. US equity futures and the dollar remain up, even though this morning’s global technical breakdown affected banking and travel services. Windows systems worldwide are down due to system updates, and the public is reassured that this was no cyberattack.

The market’s ongoing improvement in diesel supply has resulted in a market structure that remains somewhat in a carry upfront, where futures are being bought but not sold on the same day. Gasoline demand continues to fall slightly below expectations, prompting refiners to prioritize diesel production over gasoline. Unplanned refinery downtimes due to weather, such as recent incidents in Texas and Illinois, can impact the market. Be mindful that there are planned downtimes scheduled for September-October in parts of Ohio, Michigan, and the East Coast.

Earlier this week, the Great Lakes region was slammed with storms, including tornadoes shutting down an Illinois refinery due to power outages. The 251,00 bpd refinery is a key supplier in the Chicago area, leaving the Midwest refiners to scramble and stockpile gasoline. The National Weather Service reported that an EF-2 tornado touched down just across the road from the major refinery. Tornadoes are measured using the Enhanced Fujita Scale, and an EF-2 tornado has three-second gusts that range from 111 mph to 135 mph.

Authorities have reported that two massive oil tankers caught fire this morning after colliding at sea close to Singapore, the largest refueling port in the world. Two crew members were taken to a hospital, while others were saved from life rafts. Speaking of fires, Alberta is still blazing, with wildfires threatening up to half a million barrels of daily output in the oil sands region. The province has 150 wildfires burning, with 51 being out of control.

U.S. imports of crude oil from Canada rose to a record high last week, according to data from the Energy Information Administration released on Wednesday. The increase, driven by the newly expanded Trans Mountain (TMX) pipeline, saw imports rise by 807,000 bpd to 4.4 million bpd in the week ending July 12, marking the largest gain since March 2023. The $24.84 billion Trans Mountain expansion began operations in May and nearly tripled shipping capacity to Canada’s Pacific Coast to 890,000 bpd. Most of this oil is being purchased by U.S. West Coast refiners, with some shipments also heading to Asia. However, U.S. Gulf Coast imports decreased by 140,000 bpd to 1.1 million bpd last week due to Hurricane Beryl, which caused major port closures and imposed draft restrictions on vessels once the ports reopened. Exports also declined by 35,000 bpd to about 4 million bpd last week, similarly impacted by the port disruptions and restrictions.

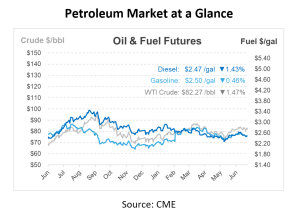

Prices In Review

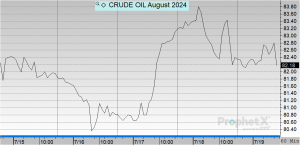

Crude opened the week at $82.16, saw nearly $1 drops the next two days, and jumped back up on Thursday. This morning, crude opened at $82.47, an increase of 31 cents or 0.377%.

Diesel opened the week at $2.5064, and also saw declines for the next two days. This morning, diesel opened at $2.4743, a decline of 3 cents or -1.28%.

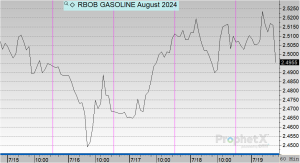

On Monday, gasoline opened at $2.5127 and saw similar drops to crude and diesel before spiking back up on Thursday. Gasoline opened this morning at $2.5057, a just shy of 1 cent decrease or -0.278%.

This article is part of Daily Market News & Insights

Tagged: impact, oil and gas, Refinery Downtimes, u.s dollar

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.