Oil Prices Decline on Concerns Over Chinese Demand and Global Economic Indicators

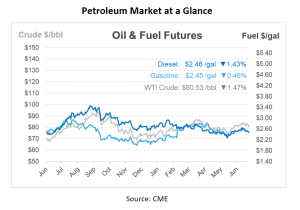

Oil prices are down over 1% this morning, with benchmark contracts falling by around $1.30/bbl. The downward pressure contributing to this decline includes dormant tropical activity in the Atlantic, weak economic statistics from China, and a stronger US dollar. Prices are pushing crude oil toward multi-month lows. The Department of Energy (DOE) has indicated that it will only purchase sour heavy crude if its price falls below $80 /bbl.

The impact of China’s weakening economy on demand is a top player for crude futures. Brent dropped $1.47 to $83.38/bbl this morning despite expectations that the U.S. Federal Reserve might start reducing its main interest rate as early as September. The Chinese economy, the world’s second-largest, grew by 4.7% in the second quarter, falling short of the 5.1% predicted by Reuters and marking its slowest pace since the first quarter of 2023. While lower interest rates could stimulate the economy and increase oil demand, some analysts caution against bullishness, noting that macroeconomic data from the US might indicate potential deterioration, which could indirectly affect oil demand.

The current situation contrasts sharply with mid-July of last year when intense heat and storms disrupted refinery output and boosted gasoline returns. This summer, however, gasoline demand has been minimal, leading most refiners to operate near maximum capacity. Consequently, gasoline margins have narrowed across the country. The NYMEX August RBOB contract fell, and the Gulf Coast gasoline crack closed at about $12/bbl above local sweet crude, half of last year’s difference. This weakness extends beyond the Gulf Coast, with spot gasoline prices dropping in the Midwest and West Coast. California gasoline prices are low, and crude oil contracts have also declined. Despite market sentiment indicating that third-quarter demand might slightly exceed supply, there has been little buying interest from refineries or funds.

China’s refinery output dropped by 3.7% in June compared to a year earlier, marking the third consecutive month of decline due to planned maintenance, lower processing margins, and weak fuel demand. Refiners processed 14.19 Mbpd of crude oil, the lowest level this year. The first half of the year’s output was down 0.4% from the previous year, the first decline since 2022. Smaller independent refineries in Shandong saw operational levels fall to 50.92% of capacity, the lowest since early 2023. Weak margins and falling demand, particularly for diesel, pose significant challenges. Despite some state-run refiners resuming operations, the overall economic recovery remains sluggish, with reduced industrial output and retail sales. However, China’s crude oil production rose by 2.4% in June, reaching the highest daily volume since June 2015, as national oil companies increased domestic production to enhance supply security. Year-to-date crude output increased by 1.9%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.