Trans Mountain Pipeline Expansion Boosts US West Coast Gasoline Supplies

The Trans Mountain Pipeline expansion, which began operations in early May, has significantly increased gasoline supplies and crack spreads on the US West Coast. In June, approximately 20 cargoes were loaded, with exports estimated at around 300,000 barrels per day (b/d). Of these, about 150,000 b/d were destined for the US West Coast, while the remainder was shipped to Asia. The pipeline is currently operating at roughly 80% capacity, transporting 710,000 b/d.

“Producers and traders are rapidly utilizing the expanded system,” said Andy Lipow, president of Lipow Oil Associates. He anticipates a rise in Canadian production due to the improved export capacity. The influx of Canadian crude is not replacing Alaska North Slope (ANS) crude oil but is displacing other foreign cargoes from Iraq, Kuwait, and Ecuador. The geographical proximity of Canadian barrels simplifies logistics and offers West Coast refiners supply flexibility.

West Coast refiners are also importing synthetic crude oil from Canada, which includes high-quality vacuum gas oil (VGO). Since 2022, US refiners have been unable to import Russian VGO and other intermediate feedstocks due to sanctions. In 2021, the US imported 673,000 b/d of crude oil and other products from Russia, including VGO.

The high-quality VGO from Canadian Syncrude is a contributing factor to the ample gasoline supplies on the West Coast as the second half of the year begins. This, coupled with weaker gasoline demand, has led to increased overall supplies. According to the latest Energy Information Administration (EIA) data, West Coast gasoline inventories are approaching 32 million barrels, nearly 2 million barrels above the five-year average.

Despite refinery runs and utilization rates being below 2023 levels, storage levels are higher than those seen in 2020 and 2021, when demand was significantly impacted by the COVID-19 pandemic. Meanwhile, in June 2024, same-store gasoline sales on the Pacific Coast were down 3.3% compared to June 2023, marking the narrowest year-to-year deficit so far in 2024.

The combination of softer demand and increased supplies has suppressed West Coast gasoline markets, occasionally resulting in negative basis differentials. On June 10, LA. CARBOB was trading at a 9.5 cents discount to futures, while San Francisco saw a 6.5 cents discount. The Pacific Northwest ended June with a nearly 20-cent discount, the widest since mid-February.

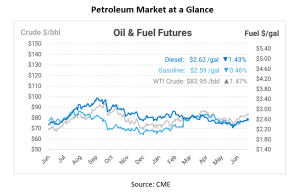

Compared to ANS crude oil, the CARBOB crack spread in June was around $19-20 per barrel in L.A. and San Francisco, with the Pacific Northwest close to $17 per barrel. For context, the RBOB crack spread on the futures market was $23.94 per barrel during June. The average ANS price in June was just below $83 per barrel, several dollars higher than Western Canadian Select (WCS) and Syncrude. Before transportation costs, WCS was $65.46 per barrel in June, based on an average discount of $13.24 per barrel.

As of May 1, the tariff on the Trans Mountain Pipeline from Hardisty, Alberta, to Vancouver for a committed shipper of less than 75,000 b/d on a 15-year contract was $8.22 per barrel. Shipping from Vancouver is estimated at about $1.65 per barrel, though this can fluctuate.

Overall, Canadian crude oil delivered to West Coast refineries can cost at least $8 per barrel less than ANS, considering tariffs and transportation costs. This has not only boosted West Coast gasoline supplies but has also impacted retail gasoline prices.

According to the latest OPIS data, the average retail gasoline price in Washington is $4.311 per gallon, a significant 67 cents below this time last year. Pacific Northwest gasoline was valued at 37 cents over futures compared to the current 19.5 cents discount. Oregon retail prices are 59 cents lower than a year ago.

California’s average gasoline price of $4.79 per gallon is about 6 cents below last year. However, some regions in the state skew the average higher, with over 5% of stations priced below $4.50 per gallon. The spread between this year’s and last year’s retail prices could widen further, given that spot prices are currently 25 cents cheaper than this time last year.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.