Hurricane Beryl Sparks Supply Concerns, Driving Oil Prices Higher

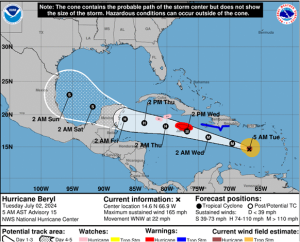

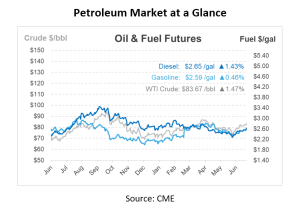

This week started the third quarter of the year, and crude oil and refined product futures posted strong gains, reaching multi-month highs. Prompt crude futures are trading up by 60c/bbl this morning, approaching a two-month high after rising over $1.50/bbl yesterday. Increased demand during the summer travel season and potential supply concerns from Hurricane Beryl are pushing prices higher. Oil prices are also being nudged by an increasing risk premium associated with Middle East tensions and indications of easing inflation in the United States, which have renewed hopes for potential interest rate cuts. Markets are closely monitoring the possible disruption to U.S. refining and offshore production as Hurricane Beryl intensified into a Category 5 storm on Monday evening, moving across the eastern Caribbean.

WTI and ULSD futures hit levels not seen since late April yesterday, while Brent and RBOB futures were also approaching those levels. The strongest moves were in the front-month contracts, which increased the backwardation in crude oil and gasoline prices and narrowed the contango in ULSD.

Hurricane Beryl intensified to a category five “potentially catastrophic” storm after making landfall in the Caribbean last night, marking the earliest occurrence of such a powerful storm in the Atlantic. This unusually fierce and early start to the Atlantic hurricane season is likely exacerbated by climate change, which has warmed North Atlantic temperatures. Beryl is projected to move West-Northwest towards Mexico, where officials are urging extreme caution since heavy rains from former tropical storm Chris have saturated the area.

China is forming a new entity that consolidates national oil producers and other state firms to explore ultra-deep oil and gas reserves and address the extraction of non-conventional resources. This initiative, announced by state energy group CNPC, aims to overcome challenges in drilling deeper onshore and developing offshore oilfields. Despite efforts yielding an annual output growth of 2% since 2018, state firms face declining production at mature fields and the complexities of extracting shale oil and gas.

According to vessel-tracking data on Sunday, approximately 20 ships loaded crude oil on Canada’s West Coast during the first full month of operation of the newly expanded Trans Mountain pipeline. This number is slightly below the operator’s forecast of 22 ships. The expanded pipeline is currently operating at around 80% capacity, with some spot capacity being utilized.

Heavy travel is expected over the next few days and into the Fourth of July holiday weekend. The American Automobile Association (AAA) has predicted a 5.2% increase in travel during the holiday period compared to last year, with passenger car travel rising by 4.8%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.