How Do Hurricanes Impact The Oil Industry?

Meteorologists are predicting a particularly active Atlantic hurricane season this year, with forecasts from AccuWeather and Colorado State University indicating between 20-25 named storms and the possibility of more than 30 hurricanes. This heightened activity suggests a significant risk of weather-related impact in the US oil and natural gas industry. The 2023 Atlantic hurricane season saw 20 named storms, but only one hurricane made landfall in the United States, with minimal impact on petroleum infrastructure. This year, however, the potential for a stronger hurricane season underscores the need for increased preparedness.

The Atlantic hurricane season, as defined by the National Oceanic and Atmospheric Administration (NOAA), runs from June 1 through November 30. Early named storms typically form in June, while the most severe hurricanes usually develop in August and early September. In the United States, hurricanes primarily impact the Southeast and the Gulf Coast, regions that are crucial to the nation’s oil and gas infrastructure. The Southeast (PADD 1C) and Gulf Coast (PADD 3) areas are particularly vulnerable to these natural disasters, which can cause significant disruptions to local economies and the energy sector.

Impact on Petroleum Markets

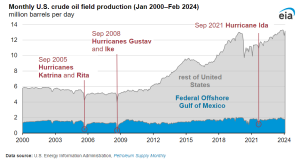

Hurricanes can severely impact oil industry by halting crude oil production and refinery operations. The Federal Offshore Gulf of Mexico (GOM) is a major hub for US offshore crude oil, accounting for 14% of the country’s production in 2023. Severe weather requires the evacuation of nonessential personnel and temporary shutdowns of production facilities to ensure safety.

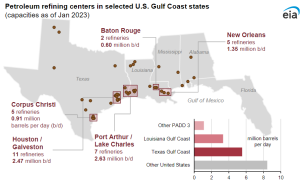

Texas Gulf Coast refineries, including clusters in Corpus Christi, Port Arthur, and the Houston-Galveston region, have a combined capacity of 5.5 million barrels per day. Major facilities in this region include Motiva’s Port Arthur refinery, Marathon’s Galveston Bay refinery, and ExxonMobil’s Beaumont and Baytown refineries. Louisiana Gulf Coast refineries add an additional 3.3 million barrels per day of capacity, with significant facilities like Marathon’s Garyville refinery and ExxonMobil’s Baton Rouge refinery.

These regions combined account for 48% of the total U.S. refinery capacity. A single hurricane could potentially take offline more than 1 million barrels per day of refining capacity, leading to extended outages or even permanent closures in the case of severe damage. Disruptions in these refineries can significantly impact the overall supply chain and market stability.

Impact Severity

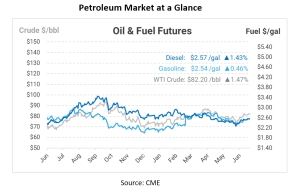

The impact of hurricanes on oil industry depends mostly on the storm’s location and intensity. A severe storm affecting a region with significant production or refining capacity can have substantial national implications. Local consumption patterns can also shift dramatically, leading to temporary spikes in fuel demand and potential price increases due to supply shortfalls or panic-buying. Hurricanes can also disrupt supply chains for petroleum products, particularly in regions like Florida that rely heavily on shipments from Gulf Coast refineries.

EIA’s Short-Term Energy Outlook

The U.S. Energy Information Administration (EIA) incorporates historical data on the Federal Offshore Gulf of Mexico (GOM) crude oil production disruptions into its Short-Term Energy Outlook. While the EIA does not specifically forecast reduced refinery activity due to hurricanes, seasonal impacts related to such events are reflected in their projections. The EIA’s outlook assumes a percentage of GOM crude oil production will be offline during each month of the hurricane season, based on the average percentage of offline monthly production during the previous ten hurricane seasons (2014–2023).

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.