Week in Review – June 28, 2024

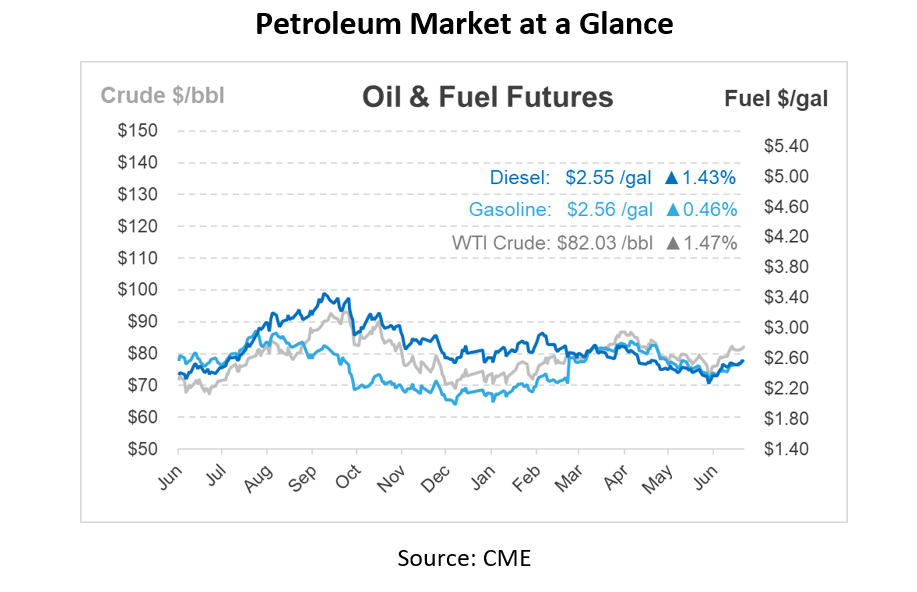

Prompt crude futures are up more than 50c/bbl this morning, continuing the upward trend from yesterday when they were up higher than 80c/bbl. Prices are expected to close the week up by more than $1.60/bbl, marking a third straight week of increases. Prompt crude prices rose to a two-month high this morning, partly due to headlines reporting on the mounting geopolitical tensions between Israel and Hezbollah in Lebanon. Strong equity futures and a slightly weaker US currency also added to crude prices this morning.

Crude increased very little in spite of geopolitical tensions due to persistent worries about a chronically high supply and dwindling global demand. WTI futures have only increased by 14% this year compared to the $71.65/bbl settlement on December 29.

Canada’s heavy crude shipments to Asia are on the rise thanks to the country’s newest oil pipeline. Since the new Trans Mountain pipeline officially opened in May, about 3 million barrels have been carried from Vancouver to China or India. Over 55% of those barrels were initially transported to Southern California, where the petroleum was loaded into very large crude carriers. June marks the first complete month of operations for the Trans Mountain system, which produces 890,000 bpd. Of that, almost 7 million barrels, largely from Cold Lake, have been delivered off the coast of Vancouver. With 3.9 million barrels received thus far in June, the US West Coast—especially Los Angeles—has been the largest recipient, next to China, India, and Ecuador.

Saudi Arabia, the world’s top oil exporter, may cut prices for the crude grades it sells to Asia for a second consecutive month in August, reflecting a decline in the Middle East benchmark Dubai. This potential price reduction shows the challenges OPEC producers face as non-OPEC oil supply continues to rise during a struggling global economy. For August, the official selling price (OSP) for Arab Light crude sold to Asia could drop by 60 to 80 c/bbl from July, potentially reaching its lowest level since April. Heavier grades like Arab Medium and Arab Heavy might see even deeper price cuts due to increasing supplies from Mexico and Canada. In response to relatively higher Saudi oil prices, Chinese refiners have reduced imports from Saudi Arabia for the third consecutive month in July.

The anticipated price cuts for August are likely to reflect a narrowing in backwardation for Dubai’s monthly price spreads, indicating easing supply tightness. Global crude futures have been buoyed by OPEC+ production cuts and peak summer demand in the northern hemisphere, which is expected to result in a supply deficit this quarter. Some analysts foresee increased supply from non-OPEC producers in the US.

Prices in Review

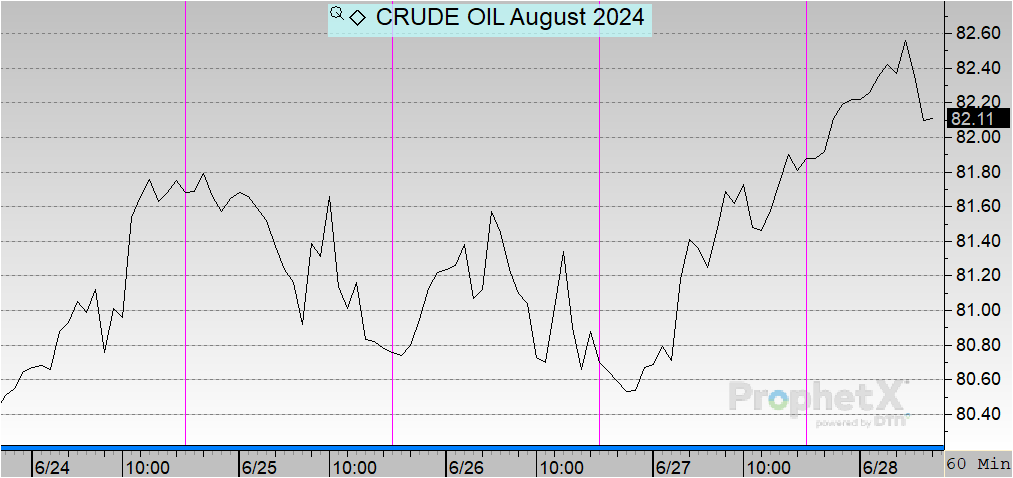

Crude opened on Monday at $80.45 before increasing slightly on Tuesday, tapering off a bit on Wednesday and Thursday, and picking back up this morning. Today, crude opened at $81.66, an increase of $1.21 or 1.5%.

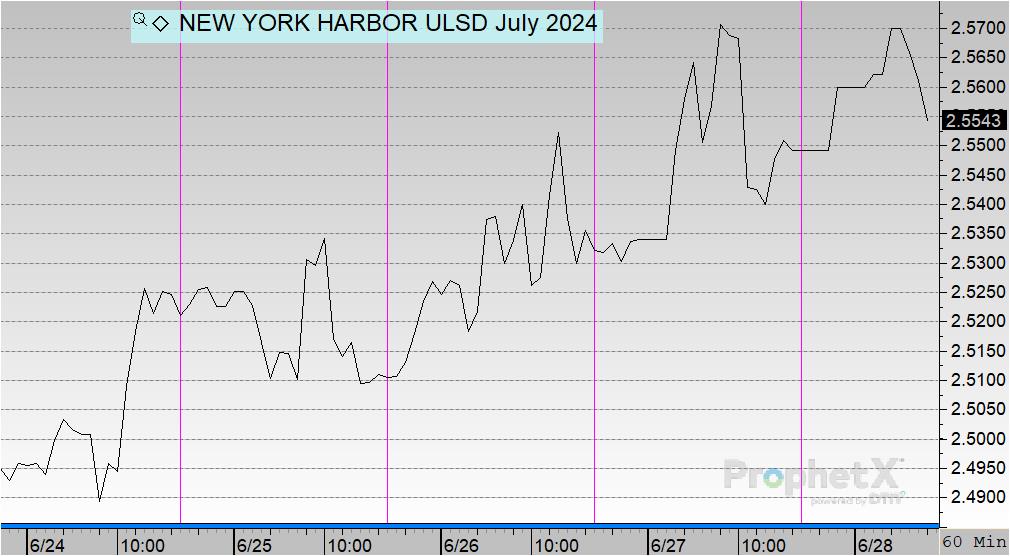

Diesel opened the week at $2.4864 and saw a couple of cents increase on Tuesday before slipping on Wednesday. This morning, diesel opened at $2.5598, an increase of 7 cents or 2.95%.

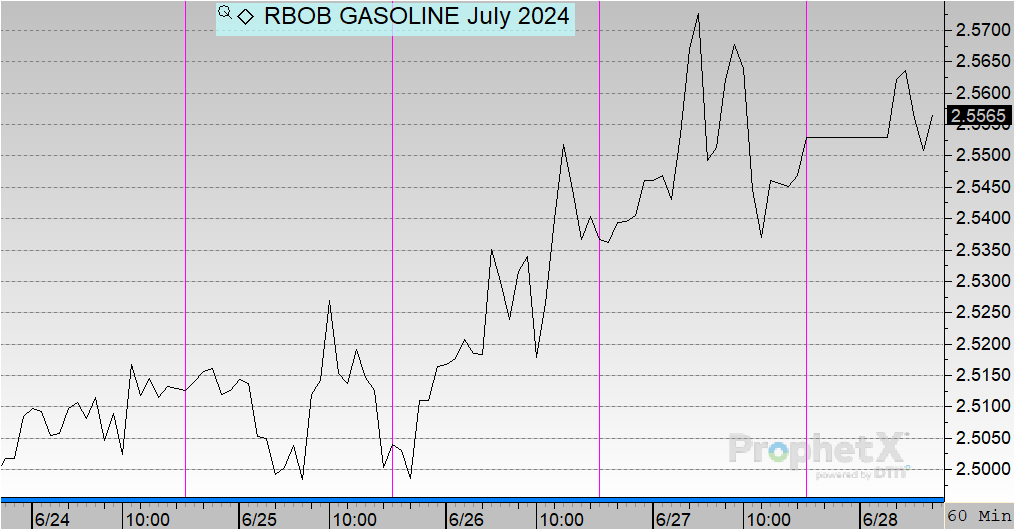

Gasoline opened the week at $2.515 and increased slightly on Tuesday, slipped on Wednesday, and increased slightly again on Thursday. This morning, gasoline opened at $2.5466, an increase of 3 cents or 1.25%.

This article is part of Daily Market News & Insights

Tagged: crude, Daily Market News & Insights, demand, diesel, fuel prices, gasoline, oil prices, opec, Supply, wti crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.