Week in Review – June 21, 2024

Crude oil prices spiked this week as hurricane season commenced. Demand also picked up while US crude and product inventories declined. The bullish sentiment was fueled by growing geopolitical concerns as more ships were sunk in the Red Sea.

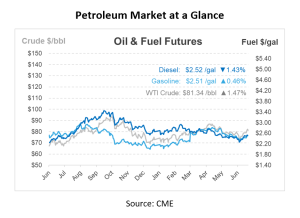

Crude oil is up slightly by 5c/bbl this morning, continuing the weekly gains. The WTI July24 contract expired at $82.17/bbl yesterday, and both the prompt month contracts saw gains of about 60c/bbl. Today, both Brent and WTI are expected to settle higher on the week. Since the beginning of June, Brent and WTI have increased by almost 10%. This is in light of OPEC’s assertion that they would reverse some of their cutbacks in the last quarter of the year.

The Energy Information Administration (EIA) released weekly data on the supply and demand of petroleum products in the United States on Thursday. The data showed a draw of 2.5 million barrels in crude stocks, a drop of 2.28 million barrels in gasoline holdings, and a decline of 1.7 million barrels in distillate inventories. According to the EIA, domestic gasoline consumption increased by around 350,000 bpd to 9.386 mbpd in the week that concluded on Friday. According to OPIS polls, consumption remained relatively constant from week to week.

The labor market appeared to be cooling, according to U.S. government statistics released this week. This raised optimism among market investors that the Federal Reserve could be willing to lower interest rates later this year.

On Thursday, the National Hurricane Center (NHC) stated that two areas of low pressure—one off the coast of Florida and another in the southern Gulf of Mexico—could intensify into tropical storms based on market fundamentals. The storm off the coast of Florida has a medium or 50% chance of formation through the next 48 hours. It is expected to reach landfall in Florida and Georgia by tonight with 10-15 mph winds. Although Alberto, the first named storm of 2024, has subsided into a tropical depression, the NHC warned that coastal flooding may still occur along Texas’ coast until Friday. The refinery-heavy towns of Corpus Christi and Houston received a lot of rain from Alberto, although most facilities reported little disruptions to their operations.

Prices in Review

*Please note that no trading occurred on Wednesday, June 19th, as the market was closed for the Juneteenth holiday.

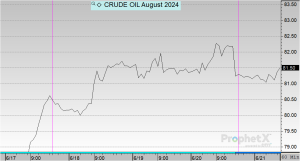

Crude oil opened the week at $78.48 and quickly reached the $80/bbl mark on Tuesday, which stuck for the rest of the week. This morning, crude opened at $81.27, an increase of $2.79 or 3.5%.

Diesel opened the week at $2.4696 and saw marginal increases throughout the week. This morning, crude opened at $2.5259, an increase of almost 6 cents or 2.3%.

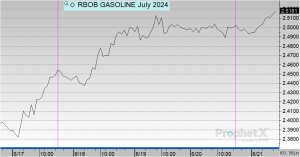

Gasoline opened on Monday at $2.4065 and also saw increases throughout the week. This morning, gasoline opened at $2.5023, an increase of about 10 cents or 3.98%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.